Dealing with clients who are reluctant to pay for SEO services is a pervasive challenge in the business world. According to a report from the National Federation of Independent Business, approximately 64 percent of businesses face the frustrating issue of unpaid invoices that are 60 days or more overdue. This problem can stem from a variety of reasons and, if left unaddressed, it can have serious implications for a company’s financial health, operational efficiency, and long-term viability. Therefore, effectively managing and resolving late payments is crucial for sustaining a healthy business.

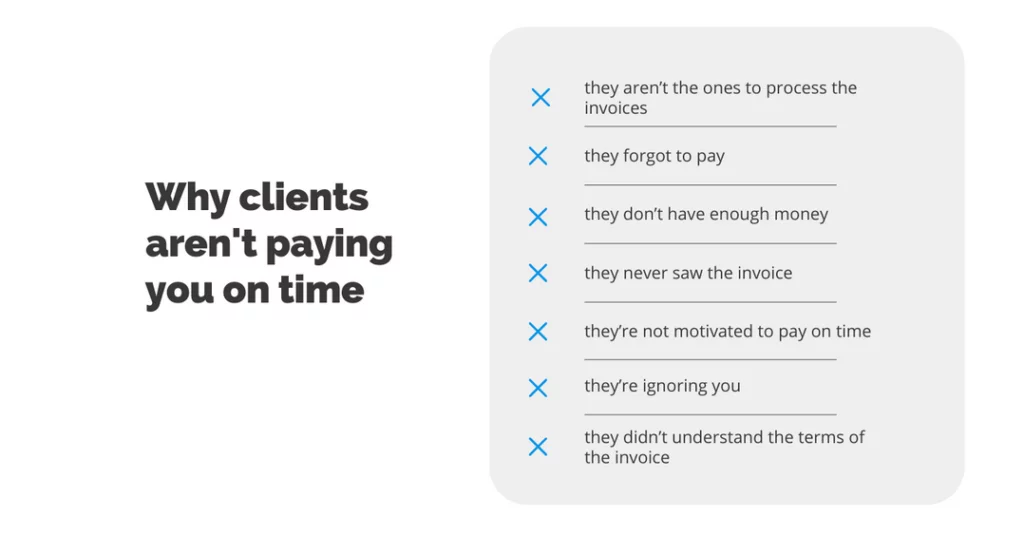

Reasons Why Clients May be Reluctant to Pay for SEO Services:

- Cash Flow Problems: Clients may face their financial constraints, particularly during economic downturns or market uncertainties. This can lead to difficulties in making timely payments for services rendered.

- Disputes over Results: Sometimes, clients may be dissatisfied with the results of the SEO services provided. They may believe that the services did not meet their expectations or were not delivered as promised, leading to disputes over the invoice.

- Operational Challenges: Clients may encounter internal issues that hinder their ability to process payments efficiently. This can include changes in accounting personnel, software malfunctions, or other operational hurdles.

- Communication Breakdown: Poor communication between the client and the SEO service provider can lead to misunderstandings about payment terms, expectations, or deliverables. This can result in payment delays.

- Disorganization: Some clients may simply lack the necessary processes or organization to manage their accounts payable effectively. In such cases, payments may be delayed due to logistical issues.

Real Life Cases to Ensure SEO Clients Pay:

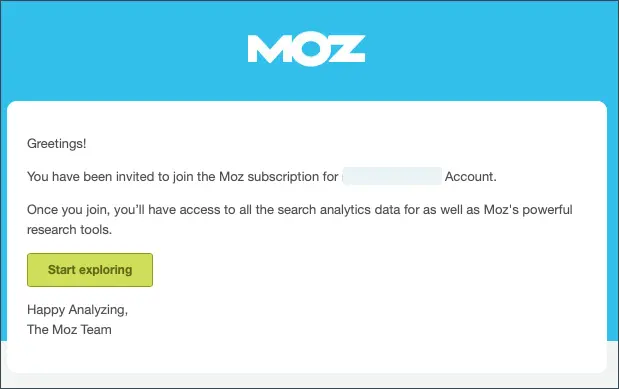

1. Understanding and Communication:

One of the initial steps in addressing late payments is to understand your clients’ circumstances. Often, clients may be willing to pay, but they face unforeseen challenges. These challenges can be either professional or personal. It’s essential for businesses to approach such situations with empathy and effective communication.

Real-Life Example: Imagine a successful digital marketing agency like Moz. Moz understands that client issues can arise due to market fluctuations or internal challenges. They engage in a personalized email conversation, addressing the specifics of the invoice and politely requesting acknowledgment.

2. Detailed Contracts:

Establishing well-documented contracts is fundamental in averting payment disputes. This practice is even more critical when dealing with recurring invoices or projects that involve variable service charges. The contract should meticulously outline deliverables, milestones, payment terms, and expectations.

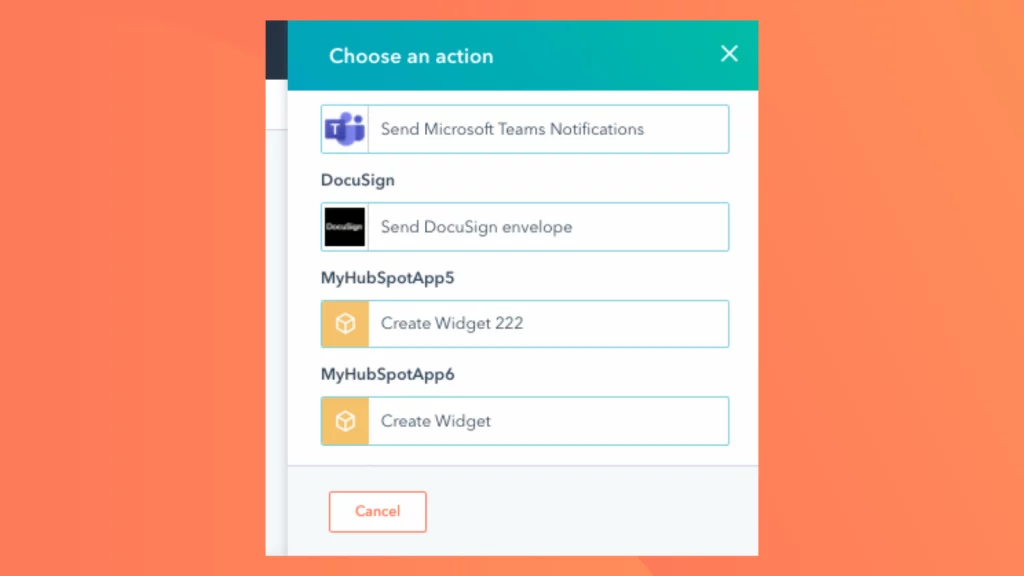

Real-Life Example: HubSpot, a leading inbound marketing and sales platform, ensures that their contracts are comprehensive and crystal clear. They use DocuSign to create legally binding contracts that detail all project aspects. This approach helps in maintaining transparency and reducing payment-related conflicts.

3. Follow-Up Strategy:

To mitigate the risks associated with delinquent clients, having a well-structured follow-up strategy is vital. Consistent communication can help prevent payment delays.

Real-Life Example: A successful e-commerce giant like Amazon employs automated follow-up reminders through their customer relationship management (CRM) system. By sending reminders a week before payments are due, they encourage on-time payments and minimize late payments.

4. Deposits and Installments:

Requesting upfront deposits and offering payment in installments can make it easier for clients to meet their financial obligations. This approach can mitigate the perception of overwhelming lump-sum payments.

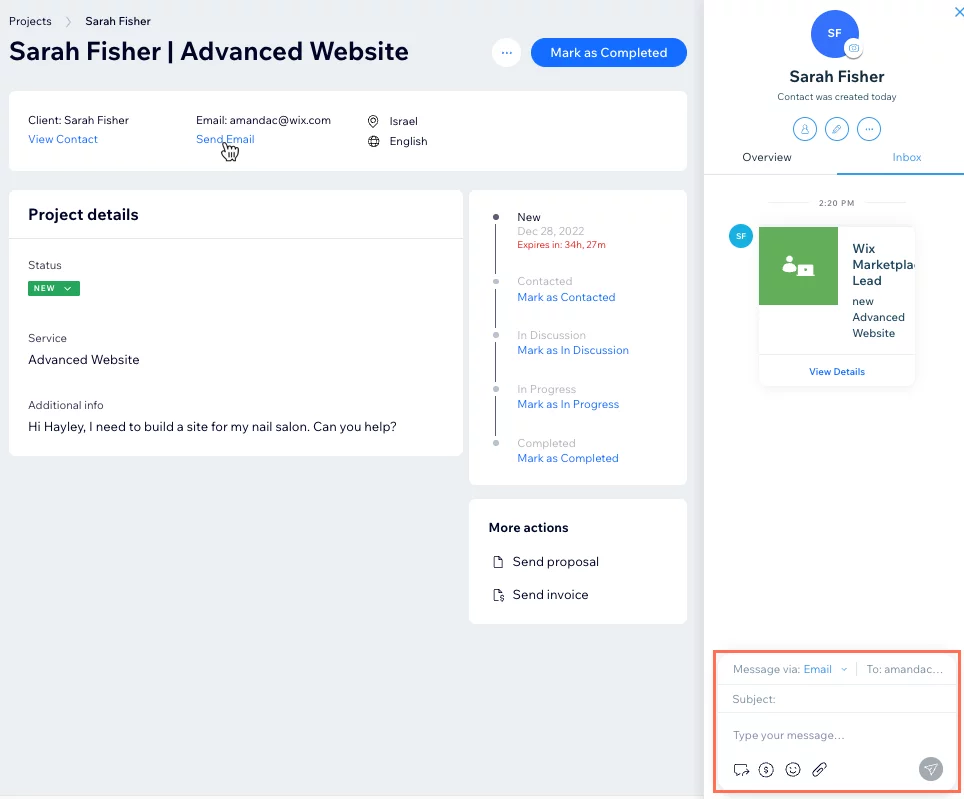

Real-Life Example: Wix, a prominent website building platform, provides an option for clients to pay a portion of the project cost upfront. By offering installment plans for the remaining balance, they make it convenient for clients to meet their payment obligations gradually.

5. Early Payment Discounts:

Incentivizing early payments with discounts is a strategy that promotes prompt payments. Such discounts can encourage clients to settle their invoices ahead of schedule.

Real-Life Example: Apple, a tech industry giant, often offers early payment discounts to their suppliers. These incentives motivate suppliers to make early payments, thereby ensuring a steady cash flow for Apple and fostering good relationships with their suppliers.

6. Politeness and Humility:

Maintaining a polite and humble demeanor when interacting with delinquent clients is essential. The goal is to collaboratively identify the root of the problem and agree on a payment solution that suits both parties.

Real-Life Example: Airlines like Emirates, known for their exceptional customer service, demonstrate humility and empathy when addressing delayed payments from passengers. They work with customers to find amicable solutions, preserving their reputation for outstanding customer care.

7. In-House Payment Systems:

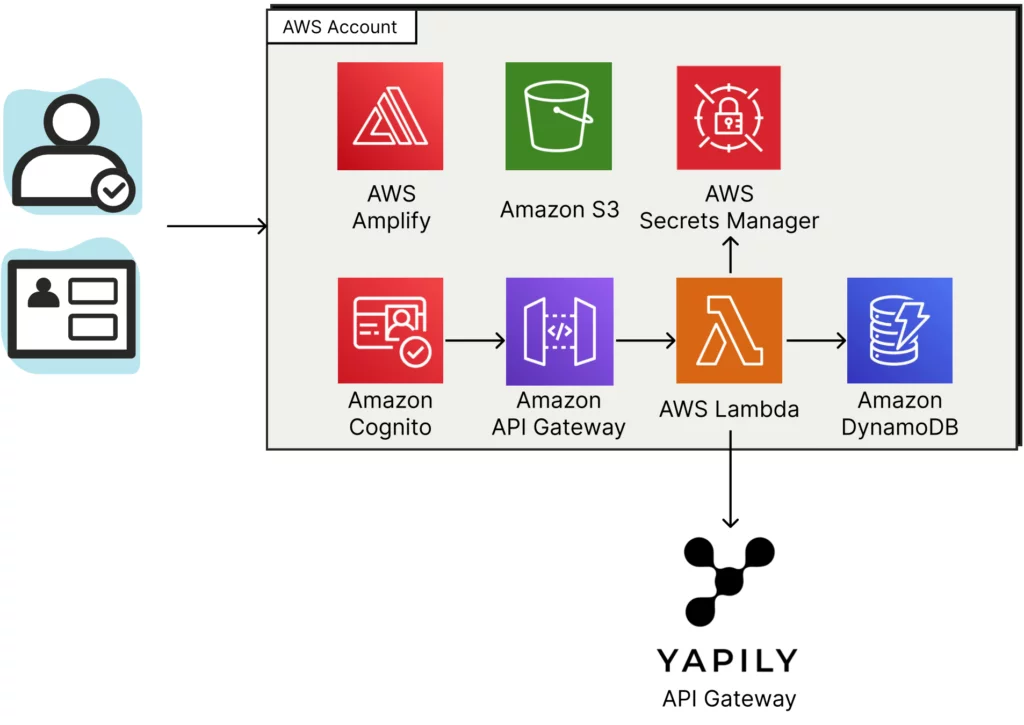

To address potential issues with payment facilities, having a flexible in-house payment system is essential. Ensure that your payment options cater to diverse client preferences.

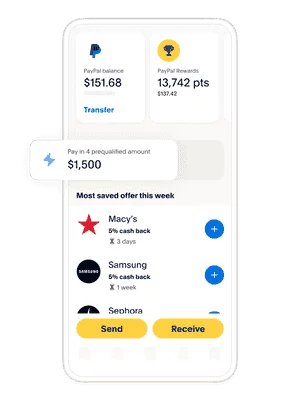

Real-Life Example: PayPal, a renowned online payment platform, regularly updates its features to meet evolving payment needs. They provide a range of payment options and continually adapt to changing payment patterns and preferences.

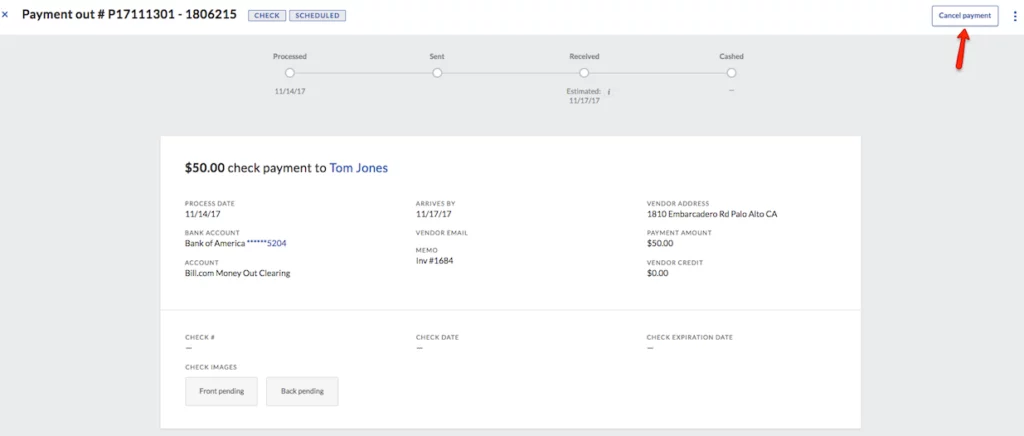

8. Consider Outsourcing:

For businesses struggling to manage delinquent clients effectively, outsourcing to collection agencies or factoring services can be a viable solution. Collection agencies are specialists in recovering overdue invoices, while factoring services offer upfront payments against accounts receivable.

Real-Life Example: The global retail giant Walmart occasionally partners with factoring companies to manage their accounts receivable. By doing so, they ensure a consistent cash flow, allowing them to continue their operations seamlessly.

9. Legal Assistance:

In extreme cases, legal action may be necessary. Engaging an attorney or pursuing claims through small claims court can be options for recovering unpaid fees.

Real-Life Example: Companies like Microsoft have the resources to pursue legal action when necessary. They consult with attorneys to evaluate the situation, and if it warrants legal action, they initiate the process to recover unpaid fees.

10. Bonus Tip: Use Your Alter Ego:

In some instances, creating a fictitious persona for your accounts receivable can nudge clients into timely payments.

Real-Life Example: Even a tech behemoth like Google has used creative strategies to encourage payments. They might occasionally adopt a playful approach, like sending reminders from a fictitious “Google Accounts” persona, making the process less intimidating.

11. Implementing a Delinquent Client Handling Plan:

Creating a step-by-step plan for addressing delinquent clients can streamline the process. Consider the following:

Real-Life Example: A successful marketing agency like Neil Patel Digital uses a structured plan to handle delinquent clients. They have a predefined sequence of actions, including email reminders, phone calls, and, if necessary, legal consultations, to systematically address payment issues.

12. Effective Communication Channels:

Utilize various communication channels to reach out to delinquent users. Email, phone calls, and even SMS can be effective ways to establish contact.

Real-Life Example: Spotify, a leading music streaming platform, employs multiple communication channels to notify subscribers of overdue payments. They send email reminders and in-app notifications, ensuring they reach their audience through various touchpoints.

13. Escalation Process:

Define a clear escalation process for cases where initial attempts to recover payments are unsuccessful. This can include involving a senior accounts manager or a collections specialist.

Real-Life Example: Utility companies like Southern California Edison have a well-defined escalation process for dealing with delinquent customers. After multiple reminders, they escalate the matter to a collections department that specializes in addressing overdue payments.

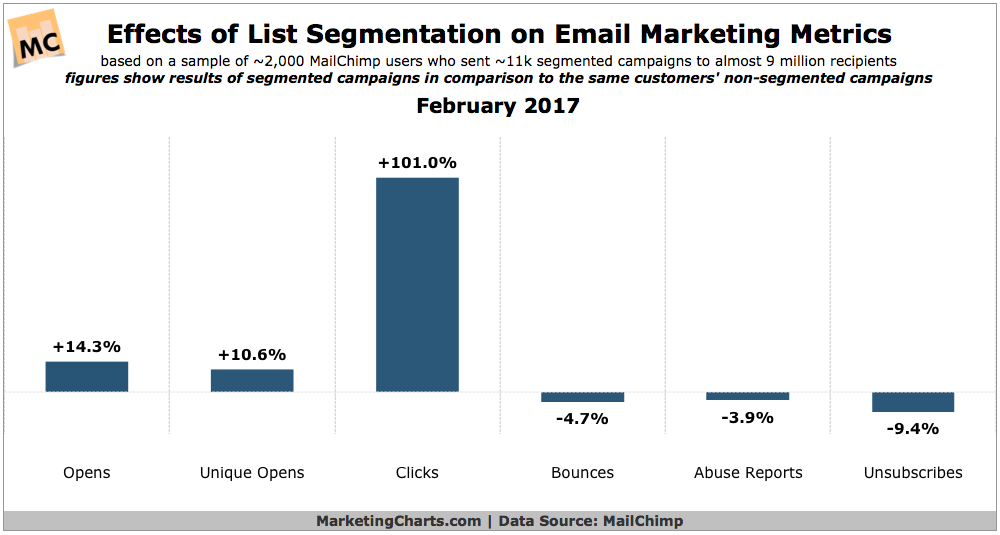

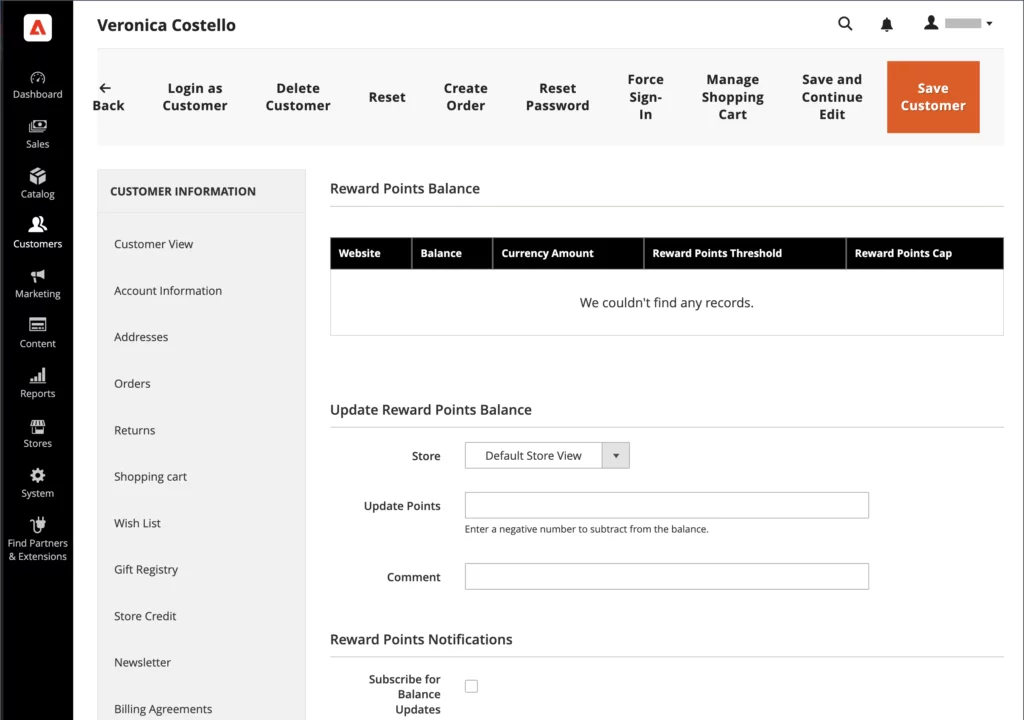

14. Client Segmentation:

Categorize your users based on their payment history and behavior. This allows you to tailor your approach, with different strategies for long-standing, high-value clients versus new, smaller clients.

Real-Life Example: Amazon Web Services (AWS) categorizes its users based on usage and payment history. They offer tailored solutions, such as extended payment terms or volume discounts, to their larger, consistent customers, while ensuring prompt follow-ups with newer clients.

15. Customer Retention and Value-Added Services:

Consider the lifetime value of your customers. Offer value-added services or discounts to users who consistently meet their payment obligations. This can encourage loyalty and reduce late payments.

Real-Life Example: Adobe, known for its software products, offers Adobe Creative Cloud subscribers additional features and discounts as a reward for consistent and timely payments. This not only retains clients but also boosts brand loyalty.

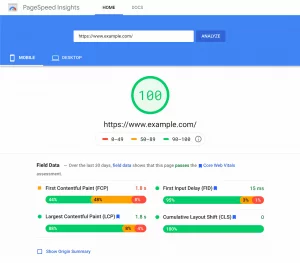

16. Data Analytics and Predictive Modeling:

Leverage data analytics and predictive modeling to identify users at risk of delinquency. By monitoring payment patterns and other relevant data, you can intervene proactively.

Real-Life Example: Credit card companies like American Express utilize predictive modeling to identify cardholders likely to miss payments. They then offer tailored payment plans to help customers manage their finances and meet their obligations.

17. Collaborative Solutions:

Engage in a problem-solving approach with clients who are facing financial difficulties. Collaboratively create solutions, such as extended payment terms or revised project scopes, to help them meet their obligations.

Real-Life Example: Consulting firms like McKinsey & Company understand that clients’ financial circumstances can change. They work closely with clients to adapt project scopes and budgets to accommodate changing needs while ensuring timely payments.

18. Feedback and Continuous Improvement:

Gather feedback from clients who have faced payment issues and use it to refine your payment processes and customer interactions. Continuous improvement is key to reducing delinquency rates.

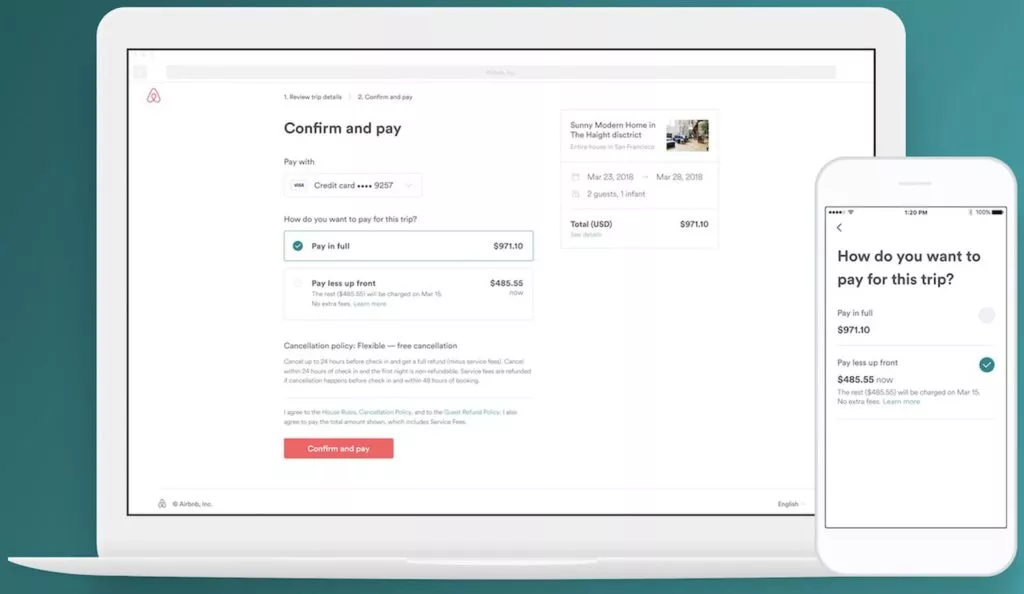

Real-Life Example: Airbnb regularly collects feedback from both hosts and guests. They use this feedback to enhance their payment and dispute resolution processes, reducing the likelihood of payment-related issues.

19. Financial Health Checks:

Regularly evaluate your clients’ financial health through credit checks or third-party financial analysis. This can help identify clients who may face financial challenges in the future.

Real-Life Example: Banks and financial institutions conduct regular credit assessments on their clients. This proactive approach helps them manage credit risk and address potential delinquency issues before they arise.

How to Mitigate Payment Failures:

- Clear Contracts and Terms: Developing a comprehensive contract is like laying the foundation of a successful business transaction. It should outline all pertinent details to avoid misunderstandings. For instance, if you’re a freelance graphic designer, your contract should clearly state the scope of work, number of revisions included in the fee, project timelines, and the payment schedule. An example clause could be:

“Client agrees to pay 50% of the total project fee upon signing this agreement and the remaining 50% within 15 days of project completion.”

- Invoice Promptly: Timely invoicing plays a pivotal role in expediting payments. After completing a project milestone or delivering a service, issue an invoice immediately. Include comprehensive details such as a breakdown of services rendered, costs, and explicit payment due dates. For example, an invoice might detail:

“Logo Design Service – $800. Payment due: November 15, 2023.”

- Communication: Maintaining open channels of communication is key to addressing any payment-related issues promptly. Encourage clients to communicate any anticipated difficulties meeting payment deadlines. Being receptive to discussing revised payment schedules if a client faces unexpected financial constraints can prevent payment delays. Regular check-ins via email or phone facilitate this dialogue and help in resolving issues before they escalate.

- Payment Policies: Integrate clear payment policies within your contracts to ensure adherence to payment schedules. Explicitly state consequences for late payments, such as late fees or suspension of services. For instance, your contract might state: “A late fee of 10% will be charged for payments not received within 30 days of the invoice date.” Such policies act as incentives for clients to make timely payments.

- Credit Checks: Before entering into significant contracts, conducting credit checks on potential clients is a prudent step. Assess their payment history and financial stability to minimize the risk of partnering with clients known for delayed or non-payments. For instance, a business offering a line of credit might utilize credit reporting agencies to evaluate a potential client’s creditworthiness.

- Legal Protection: In unfortunate scenarios where payment issues persist despite diplomatic efforts, seeking legal recourse might be necessary. Engaging legal counsel or debt collection agencies can help navigate the legal procedures involved in recovering outstanding payments. For example, a freelance writer experiencing non-payment might seek legal advice to draft demand letters or initiate legal actions for payment recovery.

Conclusion:

Securing payment conformity from clients is not merely about financial transactions; it’s a crucial aspect of maintaining a healthy business relationship. By implementing clear and transparent payment terms, fostering open communication, and leveraging technology for streamlined invoicing and payment processes, businesses can fortify their financial stability and foster trust with their clients.

Remember, the key lies in proactive measures, consistent follow-ups, and maintaining a professional yet amicable approach when addressing payment discrepancies. As the business landscape evolves, adapting flexible payment solutions while upholding payment standards is pivotal for sustained success. Upholding these practices not only ensures smoother financial operations but also cultivates stronger partnerships and a reputation for reliability within your industry.

FAQs on Recovering Payments:

When should businesses consider legal action for unpaid SEO services?

Legal action should be considered in extreme cases where all other attempts to recover payment have failed. Consulting with an attorney and pursuing claims through small claims court can be options to recover unpaid fees.

How can businesses maintain a balance between collecting payments and preserving client relationships?

Maintaining a polite and humble demeanor when addressing delinquent clients is essential. The goal is to collaboratively identify the root of the problem and agree on a payment solution that suits both parties, preserving the client relationship whenever possible.

Can outsourcing to collection agencies be a viable solution for managing delinquent clients?

Yes, outsourcing to collection agencies or factoring services can be a viable solution for businesses struggling to manage delinquent clients. Collection agencies specialize in recovering overdue invoices, and factoring services offer upfront payments against accounts receivable.