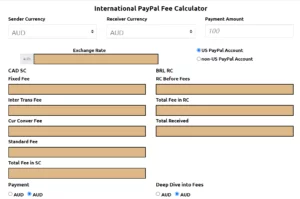

In today’s digital era, mobile or online payments have become a norm, and PayPal has emerged as one of the most well-known payment gateways in the world. PayPal Fee Calculator – an online tool that can help you calculate the fees associated with sending or receiving money through PayPal.

As you may already know, PayPal is one of the most popular online payment systems in the world, allowing you to transfer funds to anyone with an email address. But before you make a transaction, it’s important to understand the fees involved, and that’s where the PayPal Fee Calculator comes in.

Know-how of Paypal Fees

Monthly Sale

Up to $3,000 USD

$3,000.01 USD – $10,000.00 USD

$10,000.01 USD – $100,000.00 USD

Above $100,000.01 USD

International Customers (per transaction)

4.4% + Fixed Fee

3.9% + Fixed Fee

3.7% + Fixed Fee

3.4% + Fixed Fee

Seller PayPal fees: What distinguishes domestic from international payments?

The fees charged by PayPal depend on whether the transaction is classified as domestic or international.

Domestic payments refer to transactions where both the sender and recipient have PayPal accounts registered in the same country/territory.

International payments, on the other hand, are those where the sender and recipient have PayPal accounts registered in different countries/territories. However, some exceptions exist, where specific country groupings are employed to determine the rates for international transactions.

For instance, transactions involving euros and Swedish krona are considered domestic payments if the sender and recipient are both registered with PayPal in the European Economic Area (EEA).

Fees charged by PayPal when receiving an international transaction

| Sender’s Country (Might Be Your Customer) | Fee |

| Canada & US | 2.00% |

| Austria, Belgium, Cyprus, Channel Islands, Estonia, France (including French Guiana, Martinique, Guadeloupe, Reunion, and Mayotte), Germany, Gibraltar, Greece, Isle of Man, Ireland, Italy, Luxembourg, Monaco, Malta, Montenegro, Portugal, Netherlands, San Marino, Slovakia, Spain, Slovenia, United Kingdom, and Vatican City. | 0.50% |

| Slovakia, Spain, Slovenia, United Kingdom, Vatican City. Andorra, Europe II Albania, Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Hungary, Georgia, Kosovo, Latvia, Liechtenstein, Lithuania, Moldova, Macedonia, Poland, Romania, Russian Federation, Switzerland, Serbia, and Ukraine. | 2.00% |

| Aland Islands, Faroe Islands, Denmark, Finland, Greenland, Iceland, Norway, and Sweden. | 0.50% |

| Rest of the world | 2.00% |

PayPal Fee for currency conversion

In case you receive payment from international customers in a currency other than the standard currency of your PayPal merchant account, you will be charged an additional fee for currency conversion by PayPal. This fee is calculated as a markup on the exchange rate, also referred to as the “transaction rate,” and entails a conversion cost of 2.5% of the transaction value to transform your funds back into pounds.

Additional PayPal Fees for Merchants

In addition to its basic fees, PayPal charges various other merchant fees depending on how you use its service to collect payments from your customers. These fees may include:

- Advanced Credit and Debit Card Payments are applicable if you use this payment mode to add credit card buttons to your website for hassle-free card payment.

- Alternative Payment Method Rates come into play if you offer real-time bank transfers with a third-party provider.

- New Checkout Solution fees allow eligible companies to accept card payments.

- Website Payments Pro and Virtual Terminal Rates, which apply to integrated online and in-person payments.

- PayPal Here Rates (applicable for UK, GI, GG, JE, & IM only) are when you take the in-person card and contactless payments.

- Mass Payments fees allow you to organize and mail payments to multiple people at once.

- Micropayment fees are applicable to eligible businesses processing payments under $6.5.

- QR Code Fees are applicable if you accept payments through a QR code. The fee is fixed and dependent on the currency received, regardless of the amount above or below $13.

Benefits of using PayPal Fee Calculator

- Determine the fees: The PayPal Fee Calculator can help you determine the fees associated with sending or receiving money using PayPal, which can be especially helpful if you’re running a business or making frequent transactions.

- Improve Profitability by Optimizing Prices: PayPal charges a fee of 2.9% + $0.30 per transaction. By utilizing the PayPal cost calculator, you can set more competitive prices and enhance your ecommerce store’s profitability.

- Avoid Unnecessary Profit Reduction: Whether you engage in dropshipping, FBA, or run your own store, it’s important to factor in PayPal’s transaction costs when calculating profits.

- Simplify Transaction Fee Calculation: The beauty of using PayPal’s fee calculator tool is that you can easily adjust the pricing of all your products on your ecommerce platform, leading to increased profits.

- Boost Your ROI with Better Pricing: You can anticipate a rise in the ROI of your e-commerce store with enhanced payment gateway pricing and transactions.

- Maintain Your Competitiveness in E-Commerce: Avoid leaving the e-commerce market because of dwindling profitability. Instead, raise your prices and rejoin the competition.

- Make sensible choices: You can enter the transaction’s value, the currency, and whether you’re sending or receiving money into the calculator. The fee that PayPal will charge you, as well as the final sum that you will receive or send, will then be calculated. You can use this information to make better knowledgeable decisions about how to manage your finances.

- To compare fees, you can use the PayPal Fee Calculator to view the costs of various PayPal transaction types. Depending on the amount of money you’re transferring and the associated fees, you might discover that it’s more economical to utilize a bank transfer than a credit card.

Risks of using PayPal Fee Calculator

- Difference in rate at actual: It’s crucial to remember that the PayPal Fee Calculator is merely an estimate, despite the fact that it can be a useful tool. Several variables, such as the current exchange rate, the sender and recipient’s locations, and the kind of PayPal account you have, may affect the actual fees that PayPal charges.

- Changes to PayPal’s fees: It’s crucial to periodically check for updates because PayPal’s fees are subject to change.

- High-cost fees: When compared to other payment methods, PayPal’s fees can be quite high, especially if you’re using a credit card or transacting internationally. Occasionally, using different payment options like bank transfers or cryptocurrencies might be more economical.

Conclusion

For anyone who uses PayPal frequently, whether for personal or professional transactions, the PayPal Fee Calculator can be a useful tool. You’ll be better able to manage your money and comprehend the associated costs with its aid. It’s mandatory to keep in mind that the calculator just provides an estimate and that PayPal’s costs can change based on a number of variables. You may manage your money online more wisely if you are aware of the advantages and potential pitfalls of utilizing PayPal and the PayPal Fee Calculator.

FAQs

What are the reasons behind PayPal charging a fee for receiving money?

PayPal charges a fee for receiving money due to various factors:

- Payment Type: The fee levied by PayPal depends on the type of payment received. For instance, if the payment is made for goods or services within the UK, PayPal may charge a fee of 2.9% plus a fixed fee of 30p per transaction.

- Payment Source: PayPal may charge a fee for processing the payment if it is funded using a credit or debit card.

- Currency: If the payment is received in a different currency than the account currency, PayPal may charge a fee for currency conversion.

- Country: The fees may vary based on the country from which the payment is received.

How precise is the PayPal fee calculator?

You can get an idea of the costs associated with receiving payments from PayPal using a fee calculator. The actual fees, however, can differ slightly based on the particulars of the transaction.

Do I have to register in order to utilize a PayPal fee calculator?

No, using a PayPal charge calculator does not require registration or the creation of an account. The majority of calculators can be used without registering online for free.

Can I calculate PayPal fees for all kinds of transactions?

For the majority of transactions, such as purchases of goods and services, charitable contributions, and personal transfers, a PayPal fee calculator is available. The fees, however, may differ based on the nature of the transaction and other elements.

Can I trust PayPal fee calculators?

Although most PayPal fee calculators are trustworthy, it’s important to remember that they only provide an estimate of the fees and do not reflect the actual charges made by PayPal. To prevent any unforeseen expenses, you should always check the fees on the PayPal website or app before receiving payment.