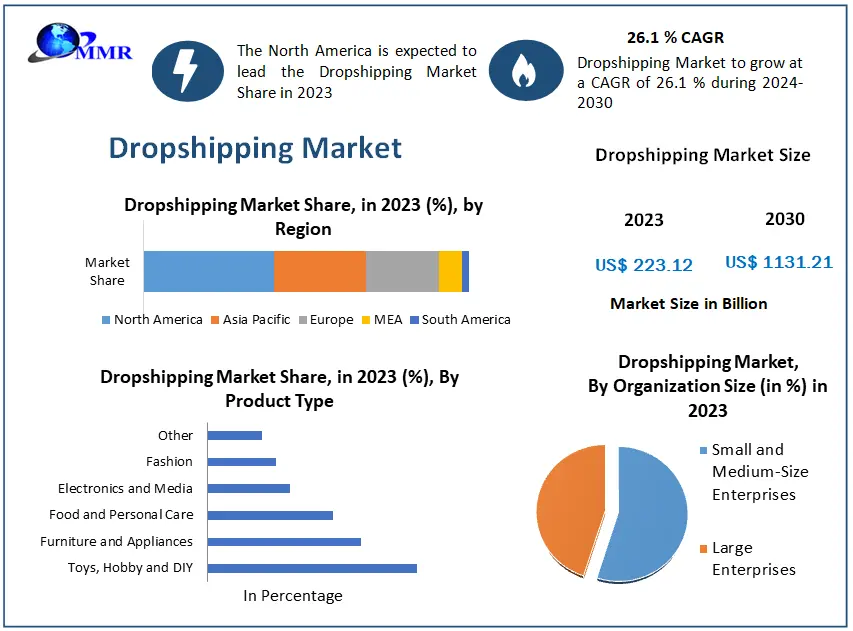

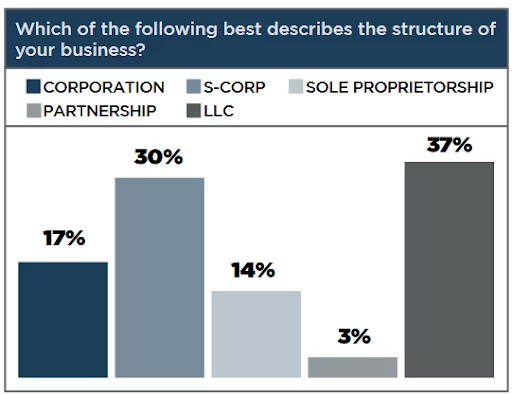

The dropshipping industry has burgeoned into a colossal entity, with some economists forecasting it to exceed a $500 billion valuation by the decade’s end. For aspiring entrepreneurs eyeing this lucrative market, pivotal decisions lie ahead. Among these, a fundamental choice concerns the business’s legal frameworkbusiness’s legal framework: Should it operate as a Sole Proprietorship or be structured as an LLC?

It’s worth noting that LLCs may vary slightly from state to state. Establishing a California LLC, for instance, might entail greater complexity or cost than its Wisconsin counterpart. Nevertheless, there are overarching principles about LLCs that all drop shippers should grasp.

What exactly is an LLC?

An LLC, shorthand for a limited liability company, represents a legal structure available for businesses. Widely adopted throughout the US, it’s favored by drop shippers and entrepreneurs across various sectors.

This distinction serves to curtail personal liability and exposure to risk. Consider this scenario: Suppose your dropshipping venture faces legal action. If you’re operating as a Sole Proprietorship, your assets, such as a family vehicle or jointly held bank accounts, could be targeted in the lawsuit. However, by operating your business as an LLC, only assets owned by the business itself are susceptible to litigation, shielding your holdings.

Given these risk-mitigating advantages, the LLC structure emerges as a relatively secure option for novice entrepreneurs, warranting severe consideration among the dropshipping community.

Why LLCs Make Sense for Dropshippers:

Exploring the numerous advantages of structuring your dropshipping business as an LLC reveals several compelling reasons why this legal framework is highly beneficial for entrepreneurs in this field:

- Limited Personal Liability: Perhaps the most vital advantage of forming an LLC is its protection against personal liability. As a dropshipper, you can shield your assets, such as savings, investments, and property, from potential lawsuits or business debts. In the event of legal action or financial difficulties, only the assets owned by the LLC are at risk, safeguarding your personal wealth and security.

- Tax Benefits: LLCs provide potential tax advantages, particularly through their pass-through taxation feature. With this structure, business profits “pass through” to the owners’ personal tax returns, avoiding the double taxation commonly associated with corporations. This means that you’ll only pay taxes once on your income, streamlining your tax obligations and potentially reducing your overall tax burden.

- Enhanced Credibility and Trust:Operating your dropshipping venture as an LLC enhances your credibility and fosters trust among potential customers. By establishing a distinct legal entity, you demonstrate a commitment to professionalism and legitimacy. Customers are more likely to perceive your business as reputable and trustworthy, as it signifies a formal, established enterprise rather than a casual endeavor or hobby.

- Access to Financing: While LLCs cannot issue shares like corporations, they offer easy access to business loans compared to sole proprietorships. Financial institutions tend to view LLCs more favorably due to their structured and formalized nature, making it easier to secure financing for business growth and expansion. This access to capital can be vital for scaling your dropshipping operations and seizing market opportunities.

- Consideration for Future Growth: Although LLCs may have limitations regarding issuing shares, they provide flexibility for future growth and expansion. As your dropshipping business evolves, you can easily adapt the LLC structure to accommodate changes in ownership, management, or business objectives. This scalability ensures that your legal framework remains conducive to your long-term strategic goals.

Establishing Your Dropshipping LLC: A Detailed Guide

Step 1: Choose Your Business Name

Selecting an enticing and legally viable name for your dropshipping company sets the foundation for your brand identity. Utilize business name generators like Looka, Namelix, or TRUiC Business Name Generator for inspiration. Ensure the chosen name is available by conducting thorough online searches and checking state registries to avoid trademark infringement.

a. Looka:

- Looka is an innovative online platform designed to assist entrepreneurs in creating memorable and impactful brand identities. Formerly known as Logojoy, Looka utilizes artificial intelligence (AI) technology to generate unique business names, design logos, and develop comprehensive branding solutions.

- With Looka, users can input keywords related to their business niche, target audience, and brand personality to receive a curated list of potential business names. The platform deploys sophisticated algorithms to analyze user preferences and market trends, ensuring the generated names are relevant and appealing.

- Looka’s intuitive interface allows users to explore various name options, customize logo designs, and visualize their brand identity across different marketing collateral. Additionally, Looka offers supplementary services such as domain name registration and social media profile creation to streamline the branding process for entrepreneurs.

b. Namelix:

- Namelix is a cutting-edge business name generator that leverages machine learning algorithms to generate creative and distinctive brand names. This user-friendly platform is ideal for entrepreneurs seeking inspiration and guidance in naming their businesses, products, or projects.

- Users can input relevant keywords, brand attributes, and preferences into Namelix’s interface to receive a personalized list of potential names. Namelix’s algorithm analyzes linguistic patterns, domain availability, and brand memorability to generate names that resonate with users and their target audience.

- Namelix offers additional features such as domain name availability checks, social media username suggestions, and trademark availability verification to ensure the selected name is both unique and legally compliant. The platform’s seamless integration with domain registration services enables users to secure their chosen name quickly and efficiently.

c. TRUiC Business Name Generator:

- The TRUiC Business Name Generator is a versatile tool designed to help entrepreneurs brainstorm and select compelling names for their businesses. Developed by The Really Useful Information Company (TRUiC), this intuitive platform offers a user friendly interface with robust functionality to streamline the naming process.

- Users can input specific keywords, industry categories, and brand preferences into the TRUiC Business Name Generator to receive tailored name suggestions. The platform employs advanced algorithms to analyze market trends, competitor names, and linguistic patterns, generating unique and relevant options for users to consider.

- TRUiC’s comprehensive approach extends beyond name generation, providing users with valuable resources and guidance on business formation, marketing strategies, and legal considerations. With TRUiC’s Business Name Generator, entrepreneurs can kickstart their ventures with a strong and memorable brand identity.

d. Shopify Business Name Generator:

- The Shopify Business Name Generator is a powerful tool designed to assist aspiring entrepreneurs in finding the perfect name for their online stores and e-commerce businesses. Integrated within the Shopify platform, this feature-rich tool offers convenience, functionality, and customization options tailored to the needs of online merchants.

- Users can input relevant keywords, industry categories, and brand attributes into the Shopify Business Name Generator to receive a curated list of name suggestions. The platform’s algorithm considers factors such as domain availability, brand memorability, and market trends to generate unique and relevant options for users to explore.

- In addition to name generation, the Shopify platform offers a suite of e-commerce tools, website templates, and marketing resources to support entrepreneurs in launching and scaling their online businesses. With seamless integration with Shopify’s ecosystem, users can seamlessly register their chosen domain name and create their online store, empowering them to bring their business ideas to life.

e. Wix Business Name Generator:

- The Wix Business Name Generator is an intuitive tool designed to help entrepreneurs brainstorm, discover, and select captivating names for their ventures. Integrated within the Wix platform, this feature offers convenience, flexibility, and customization options to suit the diverse needs of users.

- Users can input keywords, industry categories, and brand preferences into the Wix Business Name Generator to receive personalized name suggestions. The platform’s algorithm analyzes linguistic patterns, domain availability, and brand relevance to generate compelling options that resonate with users and their target audience.

- Beyond name generation, Wix provides users with a comprehensive suite of website building tools, hosting services, and marketing solutions to establish and grow their online presence. With seamless integration with Wix’s website builder, users can easily register their chosen domain name and create a professional website for their business, enabling them to showcase their brand and attract customers effectively.

Step 2: Selecting Your Registered Agent

Choosing a registered agent is a key step in the formation of your LLC, as they play a vital role to ensure legal compliance and handling official documents on behalf of the company. Here’s a detailed breakdown of what selecting a registered agent entails:

a. Understanding the Role of a Registered Agent: A registered agent works as the official point of contact for your LLC, responsible for receiving and managing important legal documents, such as government correspondence and notices of lawsuits. Every LLC is needed to designate a registered agent in order to maintain compliance with state regulations.

b. Selection Process: When selecting a registered agent, consider individuals or entities that are reliable, trustworthy, and capable of fulfilling the responsibilities associated with the role. While some states allow individuals to serve as their own registered agents, others mandate the use of a third-party service or entity.

c. Requirements and Considerations:

- Your chosen registered agent should have a physical address within the state where your LLC is incorporated. This ensures that legal documents can be promptly delivered and processed.

- Some states permit businesses or professional registered agent services to act as registered agents on behalf of LLCs. This option may offer convenience and reliability, particularly for out-of-state business owners or those lacking a physical presence in the state of incorporation.

- Ensure that your registered agent is accessible during the business hours to receive important documents immediately. Failure to maintain a registered agent or provide accurate contact information can result in penalties and legal consequences for your LLC.

Step 3: Filing LLC Formation Paperwork

Once you’ve selected your registered agent, the next step is to complete and file the necessary paperwork to formally establish your LLC. This process varies by state but typically involves the following steps:

a. Required Documentation: You’ll need to prepare and submit the appropriate paperwork as mandated by your state’s laws. This may include documents like the “certificate of formation,” “article of incorporation/certification of organization,” depending on your jurisdiction.

b. Filing Fees and Additional Costs: Be prepared to pay the required filing fees associated with registering your LLC. Additionally, consider any additional costs such as hiring a professional registered agent service or obtaining specialized licenses or permits, such as liquor licenses or health permits, if applicable to your business operations.

c. Member-Managed vs. Manager-Managed: On the filing paperwork, you’ll be required to specify whether your LLC will be member-managed or manager-managed. Member-managed structures entail direct involvement of LLC owners in daily operations, while manager-managed structures delegate management responsibilities to appointed individuals or third-party managers.

d. Considerations for Formation State: You may have the option to form your LLC in a state other than where you reside or conduct business. Some states, such as Wyoming or Delaware, are popular choices due to lower filing fees and tax rates. However, weigh the benefits against potential drawbacks, such as the requirement for a registered agent in the chosen state and the possibility of dual LLC filings.

e. Legal Compliance and Considerations: Ensure that the documentation is accurately completed and filed in accordance with state regulations to avoid delays or complications in the formation process. Be mindful of any specific legal requirements or restrictions in your chosen jurisdiction, such as naming conventions or disclosure obligations.

Learn about the best dropshipping platform here.

Step 4: Applying for an Employer Identification Number (EIN)

Obtaining an Employer Identification Number is a crucial step in establishing the official identity of your dropshipping company. Here’s a detailed guide on how to apply for an EIN and its significance in your business operations:

a. Understanding the EIN: An EIN, known as a Federal Tax Identification Number, is a unique 9-digit identifier assigned by Internal Revenue Service to business entities operating in the United States. Similar to a Social Security Number (SSN) for individuals, the EIN serves as a means of identification for tax and financial purposes.

b. Purpose of the EIN:

- While opening a bank account for the dropshipping company, you have the option to do so under your LLC using its EIN. This allows you to separate your personal and business finances, enhancing transparency and facilitating financial management.

- The EIN is essential for conducting various business transactions, including sales, contracts, agreements, purchases, and payments. It serves as a legal requirement for tax filing, hiring employees, and other regulatory compliance obligations.

c. Application Process:

- The application for an EIN is free of charge and can be completed conveniently online through the IRS website. The process is straightforward, requiring you to provide basic information about your LLC, such as its legal name, address, and structure.

- Once the application is submitted electronically, you will receive your EIN immediately, allowing you to proceed with your business operations without delay.

d. Necessity of an EIN:

- Whether you need an EIN depends on the structure and circumstances of your LLC. If your LLC has employees, multiple owners, or operates as a partnership or corporation, obtaining an EIN is mandatory.

- Even if your LLC does not meet these criteria, many business owners opt to acquire an EIN to protect their personal identity. Using an EIN instead of your SSN for business transactions reduces the risk of identity theft and enhances privacy.

Step 5: Drafting Your Operating Agreement

Creating an operating agreement is a critical aspect of forming your LLC, providing a framework for managing and governing your business. Here’s a comprehensive overview of drafting an operating agreement and its significance:

a. Purpose of an Operating Agreement: An operating agreement outlines the internal rules, procedures, and responsibilities governing your LLC’s operations. It establishes guidelines for decision-making, profit-sharing, dispute resolution, and ownership transfer within the company. Key provisions typically covered in an operating agreement include procedures for business dissolution, allocation of profits and losses among members, and protocols for transferring ownership interests to third parties.

b. Legal Requirements and Benefits: While some states may not mandate the creation of an operating agreement, having one in place is highly recommended for LLCs. Operating agreements serve as legal documents that define the structure and operation of your business, offering clarity and protection for all stakeholders. By formalizing the terms and conditions of your LLC’s operation, an operating agreement helps prevent conflicts and misunderstandings among members. It also reinforces the separation between your personal assets and those of the business, safeguarding your liability protection as an LLC owner.

c. Creating Your Operating Agreement: You can craft your operating agreement tailored to the specific needs and objectives of your LLC. Several online tools and templates are available to assist you in generating a customized agreement. While creating your operating agreement, consider consulting with an attorney in order to ensure compliance with state laws and address any unique legal considerations. Legal guidance can help you draft a comprehensive agreement reflecting the intentions and interests of all LLC members.

Step 6: Obtain Licenses and Permits

Securing the necessary licenses and permits is pivotal, contingent upon both your business’s geographical location and its industry classification. Here’s a detailed breakdown of what this process entails:

- Understanding Licensing Variability: The requisites for licenses and permits vary based on your state’s regulations and the nature of your business. While some regions mandate a general business license for all local operations, others necessitate specialized permits based on industry-specific activities.

- Industry-Specific Requirements: Certain sectors, notably those dealing with food, alcohol, healthcare, and construction, impose specific regulatory obligations, leading to the procurement of distinct licenses and permits. These may include health permits, liquor licenses, professional certifications, and building permits, among others.

- Application Procedure: Initiating the application process typically involves submitting comprehensive documentation to the appropriate governmental bodies. These submissions often require detailed information about your business structure, location, intended operations, and adherence to pertinent regulations. Depending on the licensing authority, you may undergo inspections, furnish evidence of qualifications, and remit applicable fees. Approval timelines can vary, contingent upon the complexity of the application and the regulatory workload.

- Compliance and Renewal Obligations: Upon receipt, licenses and permits must be prominently displayed and maintained up-to-date to ensure ongoing compliance. Many permits have stipulated expiration dates, necessitating periodic renewal to sustain regulatory adherence. Failure to uphold current licenses and permits may incur penalties or suspension of business activities, highlighting the importance of monitoring renewal deadlines and staying abreast of regulatory adjustments.

- Seeking Professional Assistance: Given the intricate nature of licensing procedures and the ramifications of non-compliance, seeking guidance from legal professionals or industry specialists is advisable. These experts can navigate the intricacies of the process, guarantee regulatory adherence, and address any compliance-related challenges.

Conclusion:

Dropshipping and establishing a Limited Liability Company (LLC) are both significant endeavors that require careful consideration and planning. Dropshipping offers entrepreneurs an opportunity to start an e-commerce business with minimal upfront investment and inventory management, leveraging third-party suppliers to fulfill customer orders. On the other hand, forming an LLC provides legal protection and separates personal assets from business liabilities, offering entrepreneurs peace of mind and credibility in their business dealings.

By combining the advantages of dropshipping with the protection and professionalism offered by an LLC, entrepreneurs can build a robust and scalable online business while mitigating risks and ensuring compliance with legal requirements. Whether you’re just starting or looking to expand your existing business, understanding the nuances of dropshipping and LLC formation is essential for long-term success.

FAQs on Dropshipping and LLC:

What are the tax implications of forming an LLC for my dropshipping business?

Forming an LLC can have various tax implications, depending on factors such as your business structure, income, and location. While LLCs offer flexibility in tax treatment, it’s essential to consult with a tax professional to understand your obligations and take advantage of potential tax benefits, such as pass-through taxation and deductible business expenses.

How can I ensure compliance with data protection regulations when running a dropshipping business?

Data protection regulations, such as the General Data Protection Regulation (GDPR) in the European Union, require businesses to protect customer data and ensure transparency in data handling practices. When running a dropshipping business, it’s crucial to implement robust data security measures, obtain consent for data processing, and provide clear privacy policies to comply with applicable regulations.

Are there any downsides to dropshipping or forming an LLC?

While dropshipping can offer many benefits, such as low overhead costs and flexibility, it also comes with challenges such as reliance on suppliers, potential for shipping delays, and lower profit margins. Similarly, forming an LLC involves administrative requirements, ongoing compliance obligations, and potential tax implications, so it’s essential to weigh the pros and cons carefully.