Buy Now Pay Later sounds too good to be true, doesn’t it? But it is possible to enable it in your WordPress system. It is important to understand what clients want and how to make their purchase easier and more effortless because, remember, users dislike spending time on websites, creating accounts, and searching for products.

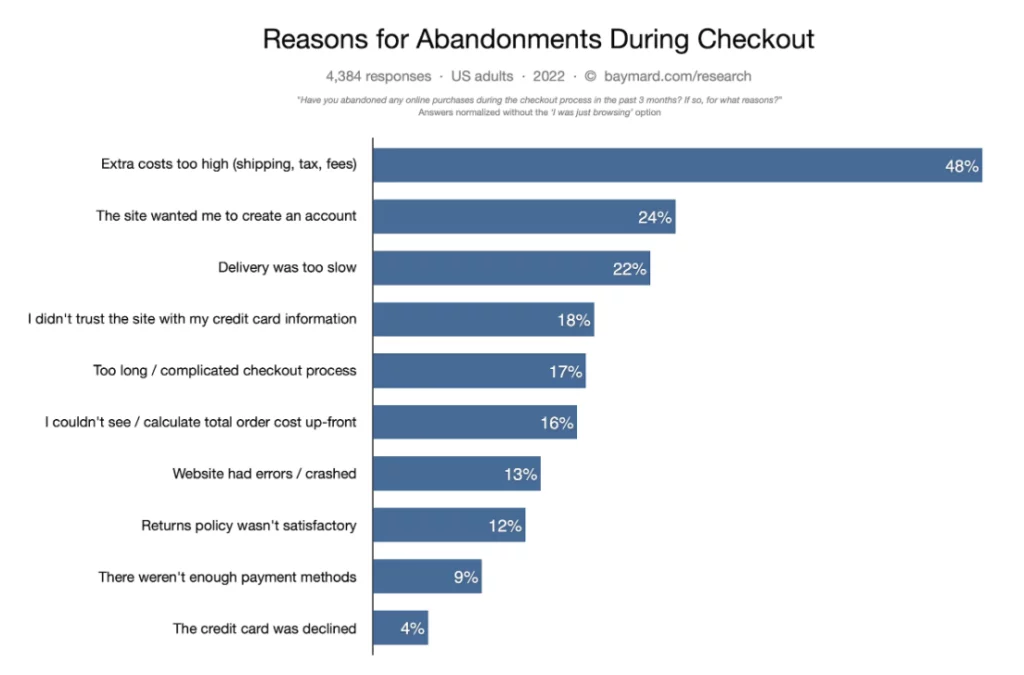

You ask why, because the average engagement is getting lower and lower by the day! People are getting lazy, and that’s a fact.Here is a study done by Baymard that shows why people abandon their purchases during checkout.

Based on Baymard research, 70.9% of shoppers abandon their carts. Furthermore, a survey of cart abandonment factors discovered that 58.6% of US online consumers abandoned a basket during the past three months because “I was just browsing or not ready to buy.”

The attraction is obvious, especially among younger generations, who are wary of debt while engaging in online shopping. Business-wise, BNPL has a value proposition. These services are used by retailers and e-commerce platforms to improve customer experiences, boost sales conversion rates, and draw in a larger audience.

Many companies provide their consumers with buy now, Pay later choices by using installment payment software. Instilling brand loyalty and encouraging repeat purchases, they appeal to the “I want it now” economy without placing immediate financial hardship on their clients.

So In this article, we will explore what Buy Now, Pay Later is and how you can enable it in your e-commerce store.

What is Buy Now Pay Later in eCommerce?

The Buy now Pay later (BNPL) is a method that revolutionizes payment by allowing customers to buy products or services immediately and settle the payment at a later date, typically in convenient installments. This popular approach in the e-commerce industry offers a flexible and customer-friendly payment solution.

Several BNPL providers exist, each with its distinct set of terms and conditions. While some providers impose interest charges on payments, others do not.

To avail of the BNPL option during checkout, customers usually undergo a credit check. Upon approval, they gain the ability to conveniently manage their payments online or through the dedicated app provided by the BNPL service.

Jaw Dropping Statistics on ‘Buy now Pay later’

The title is an eye-catcher, but these stats are more catching, these stats can change your perspective on BNPL. So let’s explore the world of BNPL with some of the most important industry facts that have shaped this ground-breaking development.

In 2021, the market for BNPLs was estimated to be worth $120 billion, and by 2030, it is expected to be worth $3.9 trillion.

- In the United States, 64% of Gen Z and 59% of millennials in the US have used BNPL in the past year.

- A study conducted by Shopify found that Businesses offering BNPL experience a 30% increase in average order value.

- BNPL reduces cart abandonment by up to 50%.

- BNPL enables businesses to reach a wider audience by catering to individuals with limited credit.

- 80% of BNPL users report high levels of satisfaction with the service.

- The number of Buy now Pay Later users could be 900 million, by 2027.

- 50% of Americans say they are interested in BNPL services.

- According to the poll, 55.8% of participants have utilized a BNPL service. In terms of gender, 51.36 percent of women and 62.8% of men utilized BNPL.

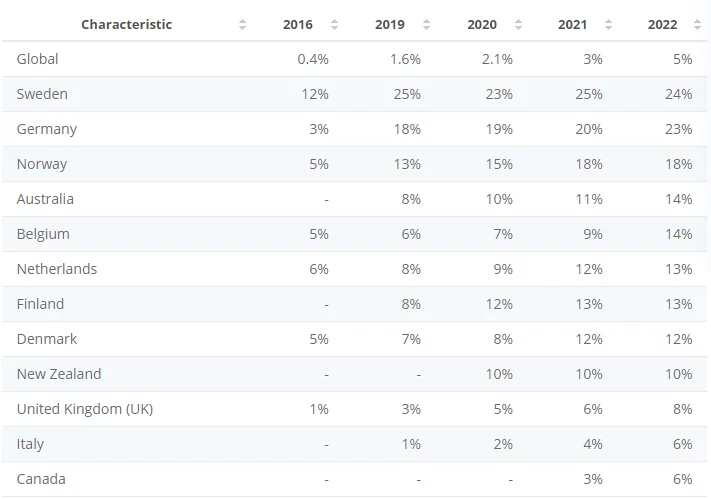

Statista reports that Due to customer demand for new e-commerce payment options, eight out of the top ten global buy now, pay later (BNPL) markets in 2022 were situated in northwest Europe. For instance, BNPL services held a market share that was around 10 times larger in domestic e-commerce payments in Sweden and Germany than it did globally.

Benefit of using Buy Now Pay Later

There are several benefits of BNPL, some of the most popular includes…

- Amplified Sales: By making purchases more affordable, BNPL drives an increase in sales volume, enabling customers to access your products with ease.

- Elevated Customer Satisfaction: With BNPL, customers gain the flexibility to choose their preferred payment method, resulting in higher satisfaction levels throughout their purchasing journey.

- Reduced Cart Abandonment: The option to defer payment encourages customers to complete their purchases, reducing the likelihood of cart abandonment and increasing conversion rates.

- Upsurge Average Order Value: BNPL empowers customers to purchase higher-priced items, thereby boosting their average order value and revenue potential.

- Enhanced Customer Loyalty: Providing a positive BNPL experience fosters customer loyalty, reinforcing their connection to your business.

How does the BNPL work?

The concept of buy now pay later revolves around customers entering into an agreement that obligates them to make payments encompassing both the principal amount and interest charges of a loan. This process can be intricate when handled directly, but opting for a third-party solution can simplify matters.

Take, for example, the integration of a trusted third-party entity like Affirm. By choosing the BNPL option, customers authorize Affirm to cover the complete cost of the desired product and then collaborate with the buyer to facilitate repayment. It’s worth noting that BNPL lenders such as Affirm typically impose a fee ranging from 3% to 5% of the total sales as compensation for their services.

BNPL providers typically conduct soft checks on customers, ensuring that loans are extended to individuals with a reliable repayment capacity. By managing the intricacies of loans and potential fraudulent activities, these providers free up your time and allow you to focus on your core business objectives.

How to Enable Buy Now, Pay Later Payment

Step 1: Installing the WooCommerce Plugin

To begin, proceed with the following steps to add the Affirm payment gateway plugin from the WooCommerce extension store:

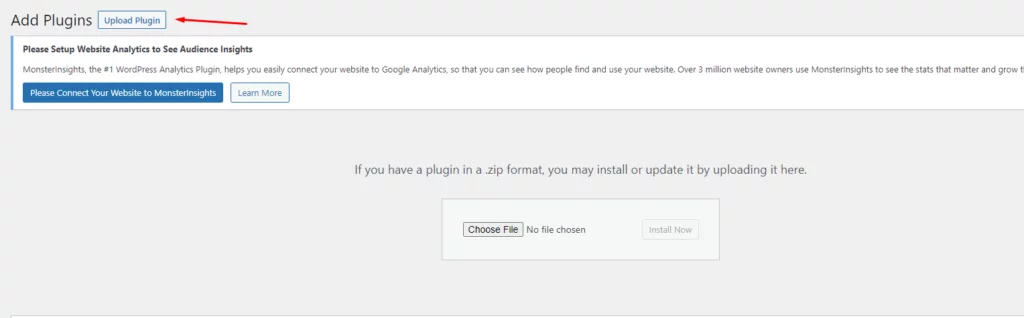

- Go to Plugins > Add New on your WordPress Dashboard.

- Click on the Upload Plugin button and select the Affirm downloaded file.

- Proceed by clicking Install Now and then Activate.

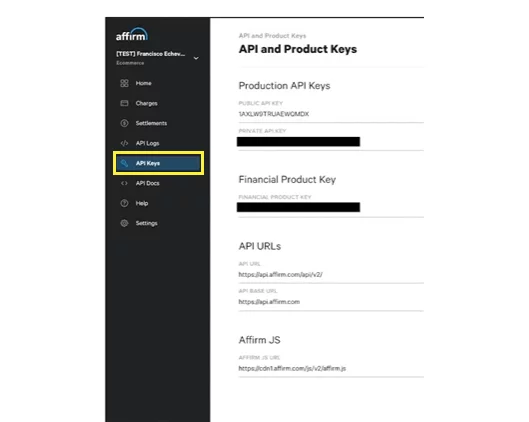

Step 2: Obtaining API Keys from the Affirm Merchant Portal

Now that the Affirm Plugin is successfully installed in WooCommerce, take the following steps:

- Log in to the Affirm Merchant Portal and locate the API Keys section.

- Access the API section to retrieve the necessary keys.

Step 3: Configuring the Affirm Plugin

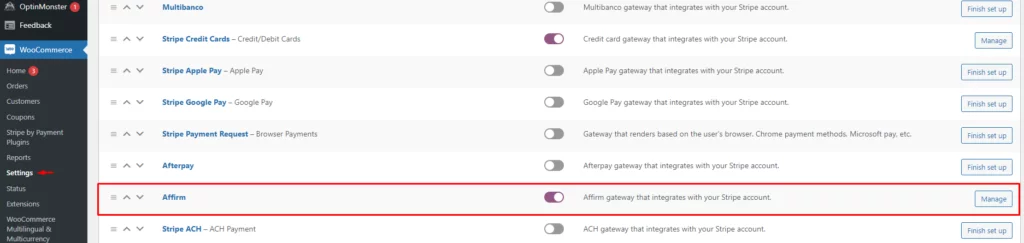

Navigate to WooCommerce > Settings > Payments and select Affirm to configure the plugin:

- Choose the desired Enable or Disable option; for this case, select Enable.

- Activate the Affirm Sandbox box if you wish to test the payment gateway without conducting actual transactions.

- Enter the Public API Key and Private API Key obtained in Step 2.

- Select a Transaction Mode.

Step 4: Configuring the Affirm Payment Gateway

Once the Affirm Plugin has been set up, follow these instructions to change how clients interact with the Affirm checkout interface:

- Choose the Checkout Mode:

- Modal activates a pop-up during checkout.

- Redirect redirects the customer offsite to complete the checkout process.

- Select an Affirm Color: blue, white, or black.

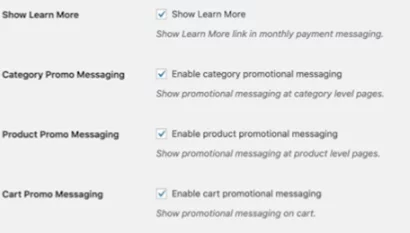

- Decide whether to Show Learn More, displaying a link in Affirm monthly payment messaging.

- Utilize the Promo Messaging boxes to promote Affirm as a payment plan option on your Category, Product, and Cart pages.

- Optionally, set the Order Minimum or Order Maximum.

- Enable Debugging messages if troubleshooting is required.

- Leave the Enable Enhanced Analytics unchecked.

- Click on Save Changes.

Voila! This is how Affirm will appear as a payment method during checkout!

With Buy Now Pay Later integrated into your WooCommerce store, you have found the ideal solution.

Let’s explore other payment alternatives that can enhance customer satisfaction, boost conversion rates, and improve your business’s revenue.

Alternate Payment methods

Codecanyon – PostPaid – Buy Now Pay Later

- Allows customers to pay later within set limits.

- Reduces cart abandonment, requires document verification.

- Provides transparency, holds WP Requirements Compliant Badge.

- Top feature: Interest charges on PostPaid transactions.

- Pricing: Regular License $45, Extended License $225.

- Complete WooCommerce solution with multiple payment options.

- Smooth purchase experience, managing APMs and cards.

- Flexible payment periods and options.

- Enhances average order value and provides performance tracking.

- Top feature: Mobile-optimized checkout and one-click repeat purchases.

- Pricing: Free.

- Standalone payment solution, integrates with existing checkout process.

- Offers unique payment options, boosts purchasing power.

- Compliant BNPL solution with credit risk absorption.

- Top feature: On-site messaging for eligibility checks and personalized information.

- Pricing: Free.

- Splits large payments into interest-free installments over 6 weeks.

- Instant approval decisions, integrated with major eCommerce platforms.

- Access to a large network, no hidden fees or credit reporting.

- Top feature: 0% interest, no impact on credit scores.

- Pricing: Request a demo.

- Allows customers to make interest-free installment payments every 2 weeks, with no application fees or credit checks.

- Affirm streamlines checkout, reducing steps and fields, and provides risk management.

- Popular among large retailers like Urban Outfitters, Free People, and Sketchers.

- Features include Cross Border Trade, AI-powered risk assessment, and Afterpay Business Hub.

- Top feature: Daily settlement reports for order verification.

- Pricing: Free.

Conclusion

The “Buy now Pay later” payment option has revolutionized the eCommerce industry by providing customers with greater flexibility and convenience. By enabling this feature on your eCommerce platform, you can enhance the shopping experience, attract more customers, and drive sales. Follow the steps outlined in this article to enable Buy now Pay later successfully. Stay informed about the latest trends in eCommerce to continue offering innovative solutions that meet the evolving needs of your customers.

FAQs on Buy Now Pay Later

Can all customers use Buy now Pay later?

Yes, most Buy now Pay later providers offer their services to customers of all credit backgrounds. However, some providers may conduct a soft credit check to assess the customer’s eligibility for this payment option.

Are there any fees associated with Buy now Pay later?

While many Buy now Pay later services offer interest-free installment plans, some providers may charge fees for late payments or extended payment terms. Reviewing the terms and conditions of the particular service you select is crucial.

Can Buy now Pay later increase conversion rates?

Yes, implementing Buy now Pay later as a payment option can lead to higher conversion rates. By offering customers a flexible payment solution, you reduce barriers to purchase and increase the likelihood of completing a transaction.

What happens if a customer defaults on their payments?

If a customer fails to make their Buy now Pay later payments, the responsibility falls on the provider rather than the merchant. The provider will attempt to collect the outstanding balance from the customer directly.

Is Buy now Pay later secure?

Yes, Buy now Pay later services utilize robust security measures to protect customer information and transactions. It’s important to choose a reputable provider that prioritizes data privacy and implements encryption technologies.