The best payment gateway for WooCommerce will shape the store’s destiny.

For in this choice, the pulse of trust shall beat,

In every purchase, every click, complete.

If you’re using WordPress to power your online store, WooCommerce is likely your platform of choice. And you’re in the right hands!

WooCommerce stands as the foremost eCommerce platform globally. Here’s why:

- Over 6.6 million websites are powered by WooCommerce.

- In 2023, it commanded 37.7% of the market share, significantly outpacing rivals such as Squarespace Online Stores (14.67%) and WooThemes (14.95%).

- The WooCommerce plugin is downloaded 30,000 times daily from WordPress.org.

- It has facilitated 12,639 websites and generated $100,000 in sales.

WooCommerce is a favored choice among online retailers.

It integrates with over a hundred payment gateways, offering various options to suit your needs.

What is a Payment Gateway?

A payment gateway software solution enables merchants to process electronic payments, primarily credit cards. It acts as a secure intermediary, encrypting sensitive information like credit card numbers during transmission from the customer to the merchant. The gateway then forwards the transaction details to the customer’s bank and the merchant’s acquiring bank for processing.

The primary function of a payment gateway is to authorize credit card transactions and ensure the secure transfer of funds from the customer’s account to the merchant’s account. Generally, payment gateways charge a monthly fee and a fee for each transaction.

Learn about the art of payment processing here.

Types of Payment Gateways:

1. Redirect Payment Gateways

Redirect payment gateways send customers away from the merchant’s website to complete their payment. Customers are directed to the payment processor’s site or portal to finalize the transaction.

When customers reach the checkout page and select their payment method, they are redirected to a third-party service, such as PayPal or Stripe. They enter their payment details on this external site, and after the transaction is completed, they are redirected back to the merchant’s website.

This method enhances security by keeping sensitive payment data away from the merchant’s site. However, redirecting can disrupt the user experience and make the checkout process less seamless.

2. Hosted (Off-Site) Payment Gateways

Hosted payment gateways allow customers to make purchases on the merchant’s website or at a retail location, with payment information processed on the provider’s servers.

Customers enter their payment details on the merchant’s platform, but this information is securely transmitted to the payment provider’s servers for processing. Payment services like Stripe and Square POS use this approach.

This method ensures that sensitive payment data is managed off-site, which reduces the merchant’s responsibility for security compliance. However, careful integration is required to maintain a smooth user experience on the merchant’s site.

3. Self-Hosted (On-Site) Payment Gateways

Self-hosted payment gateways process the transaction on the merchant’s website or server, from data entry to payment processing.

Customers enter their payment information directly on the merchant’s site, and all data processing occurs on the same server without redirecting to an external site.

This method gives merchants complete control over the payment process and customization options. However, it also means that the merchant is responsible for securing payment data and ensuring compliance with security standards, which requires significant resources and effort.

Deep dive into how payment gateways work in consensus with POS for optimal ecommerce experience here.

Best Payment Processors for WooCommerce: How They Help

1. Seamless Transactions

Payment gateways integrate with WooCommerce to offer a smooth checkout experience and support various payment methods, which helps reduce cart abandonment and caters to diverse customer preferences.

2. Enhanced Security

They employ advanced fraud prevention techniques and adhere to PCI-DSS standards to safeguard sensitive payment information.

3. Increased Customer Trust

Familiar payment options like PayPal and Stripe build customer confidence, while encryption and tokenization ensure the security of financial data.

4. Streamlined Operations

Automation of payment processing and comprehensive reporting simplifies transaction handling and financial management.

5. Global Reach

Payment gateways facilitate transactions in multiple currencies and offer region-specific payment methods, expanding your reach to international customers.

6. Scalability and Flexibility

They handle varying transaction volumes and offer customizable features, allowing you to scale and adapt to your business needs.

7. Efficient Financial Management

Automated reconciliation and chargeback support streamline accounting and simplify dispute resolution.

8. Enhanced Customer Experience

Faster transactions and mobile-optimized payment solutions enhance convenience and satisfaction for customers.

9. Reduced Fraud Risk

Advanced security measures and dispute management tools help minimize fraud and manage transaction disputes effectively.

10. Business Insights

Detailed transaction data and performance metrics provide valuable insights into customer behavior and help optimize the business operations.

Finding the Best Payment Gateway for WooCommerce:

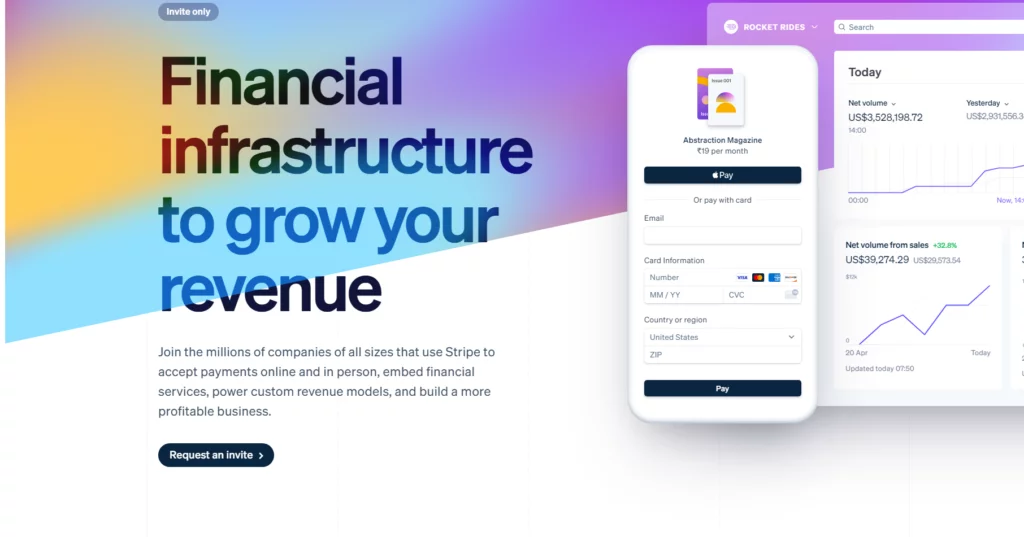

1. Stripe

Stripe is a leading name in eCommerce, trusted by millions of businesses globally for their payment processing needs.

Integrating seamlessly with WooCommerce, Stripe allows you to manage payments directly from your WordPress dashboard without needing additional platforms or plugins.

It supports a diverse range of payment methods, including credit cards, debit cards, and famous digital wallets like Apple Pay and Google Pay. Whatever payment method your customers choose, Stripe is likely to accommodate it.

Transaction Fees

- 2.9% + $0.30 per transaction

- International charges vary based on services used

Main Features

- Accepts 27 payment methods

- Embeddable checkout

- PCI compliant

- Available as a WooCommerce plugin

- Comprehensive financial reporting

Payment Methods

Stripe supports over a dozen payment methods, including major credit/debit cards, Apple Pay, AliPay, Google Pay, and more.

Pros

- Available in 42 countries

- Supports over 135 currencies

- Developer-friendly with extensive documentation

- Renowned for excellent customer support

- Costs are competitive with industry standards

Cons

- High transaction fees

- Additional fees for various services

Takeaway

Stripe is an exceptional choice, especially for businesses with international sales. We recommend it as the top payment gateway for its versatility and robust features.

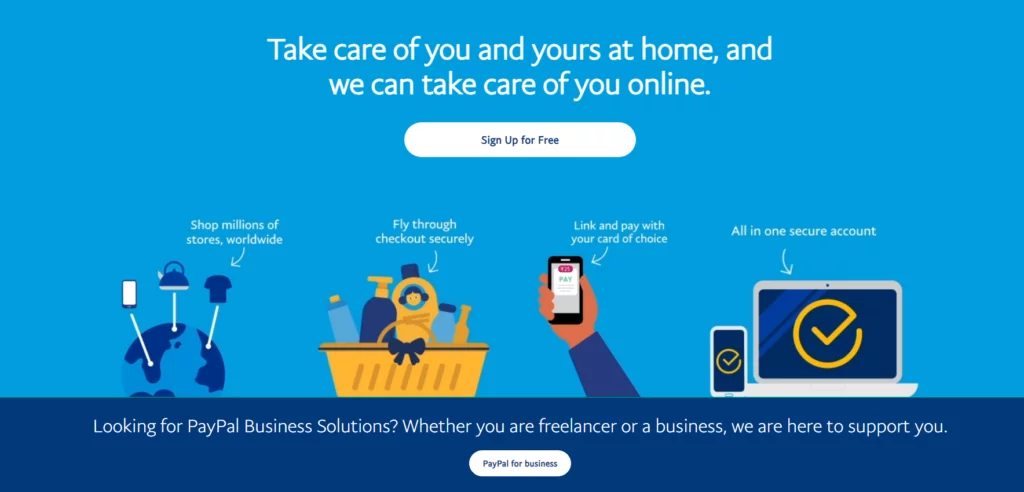

2. PayPal

PayPal is a globally recognized platform with millions of active accounts, offering a straightforward shopping experience. Customers only need to log in through a PayPal popup to complete their purchases, eliminating the need for entering account or credit card details.

The process is streamlined and secure, with PayPal handling payments and transferring funds to you. Store owners benefit from enhanced security without the need for additional considerations.

Transaction Fees

- 2.9% + $0.30 per transaction

- Additional 1.5% for international transactions

- Varies based on the services used

Main Features

- Professional-looking invoices via email

- Customizable API

- Fast payments, usually credited within minutes

- In-person payments via PayPal terminal

- WooCommerce plugins for features like Express Checkout

Payment Methods

PayPal supports payments from bank accounts, Visa, MasterCard, American Express, Discover, and PayPal Cash, among other methods.

Pros

- Available in over 200 countries

- Supports 20 currencies

- Widely familiar to most users

- Easy to set up and use

- Broad international availability

Cons

- Less developer-friendly

- Fees apply to various services

- Larger company with a less personalized touch

Takeaway

PayPal is a reliable default choice for most eCommerce stores. It offers a quick setup for WooCommerce shops and pairs well with Stripe.

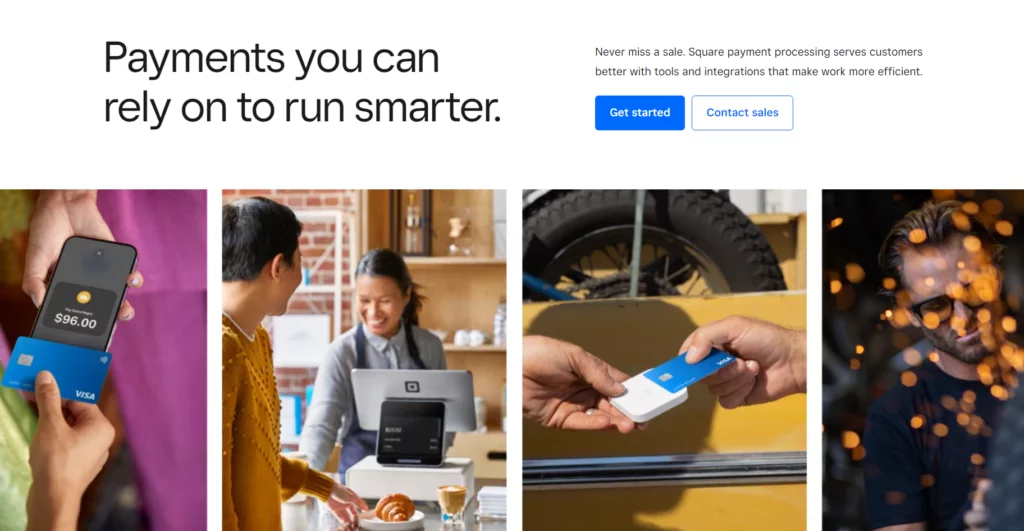

3. Square

Square is a versatile payment gateway that caters primarily to in-person stores but also offers flexibility for online stores via the Square for WooCommerce plugin.

If your WooCommerce store complements a physical location, Square is ideal as it syncs payments and inventory seamlessly. It integrates with WooCommerce Subscriptions and supports digital wallets such as Apple Pay and Google Pay.

Transaction Fees

- 2.9% + $0.30 per transaction

- Monthly plans available with additional features and discounted fees

Main Features

- WooCommerce support with a plugin

- Accepts both in-person and online payments

- Automatic synchronization with Square devices

- Supports delivery, in-store pickup, coupons, invoices, and appointments

- Integration with Instagram

Payment Methods

Square supports debit and credit cards, Square gift cards, Apple Pay, Google Pay, invoices, cash, checks, and other payment types.

Pros

- Available in the US, Canada, Japan, Australia, and the UK

- Multiple supported currencies

- Integrates in-person and online payments

- Supports invoicing and subscriptions

- User-friendly design

Cons

- Limited availability in some countries

- More suited for in-person sales than online-only eCommerce

Takeaway

Square is a solid option if you handle in-person and online transactions. However, it may not match the capabilities of Stripe or PayPal for online-only businesses.

4. Authorize.net

Authorize.net, a Visa subsidiary, may not be as widely used as Stripe or PayPal, but it serves over 400,000 active merchants and handles more than 1 billion transactions annually.

The Authorize.net plugin for WooCommerce is robust. It enables the acceptance of credit cards in multiple currencies from various locations. Customers can store credit card and bank account details for fast and secure checkouts without leaving your site.

Transaction Fees

- 2.9% + $0.30 per transaction

- $25 Monthly fee

Main Features

- Advanced fraud detection and prevention

- Supports recurring payments

- Accepts a wide range of payment types

- Simplified checkout options

- 24/7 support

Payment Methods

Authorize.net accepts Visa, MasterCard, Discover, American Express, JCB, PayPal, Visa SRC, Apple Pay, Chase Pay, e-checks, and other payment types.

Pros

- Backed by Visa

- Supports 11 currencies

- Extensive reporting features

- Lower rates for higher transaction volumes

- Offers POS and in-person payment options

Cons

- Limited availability in some regions

- Monthly fee plus transaction fees

Takeaway

Authorize.net is best suited for established businesses rather than small startups. The combination of monthly and transaction fees may only be ideal for some.

5. Amazon Pay

Amazon Pay is convenient, allowing customers to use their existing Amazon accounts to pay for your products and services. This integration streamlines the checkout process and can improve the shopping experience on your WooCommerce store.

The free Amazon Pay plugin makes integration effortless, and it even enables voice-activated shopping through Alexa, adding a futuristic touch to your eCommerce operations!

Transaction Fees

- No transaction fees

- No monthly costs

Main Features

- Accepts payments via Amazon accounts

- Optimized for mobile devices

- Supports businesses of all sizes, including nonprofits

- Alexa integration for voice-activated orders

Payment Methods

Amazon Pay supports various payment options, including immediate charges, deferred payments, split payments, and recurring payments.

Pros

- Available in over 170 countries

- Supports 12 currencies

- Simple setup and user-friendly interface

- Most customers already have an Amazon account

- No monthly or transaction fees

Cons

- Amazon is also a major competitor

- Amazon retains more customer data compared to using your own payment system

Takeaway

Amazon Pay is an excellent choice for merchants whose customers already have Amazon accounts. It simplifies the checkout process, potentially reducing cart abandonment and boosting sales.

6. Apple Pay

Apple Pay, designed for iPhones, iPads, Apple Watches, and other iOS devices, offers a sleek and secure payment solution. It requires customers to confirm their identity with a password, FaceID, or Touch ID, significantly enhancing security and reducing fraud.

Its user-friendly design makes for an attractive checkout experience, ideal for businesses seeking a high-quality payment gateway.

Transaction Fees

- Only card company fees apply

Main Features

- Supports payments online and in-person

- Compatible with most recent Apple devices

- Accepts most credit and debit cards

- Offers “Pay Later” options

- Integrates with WooCommerce via Stripe

Payment Methods

Supports most credit and debit cards and Apple Cash (available in the US) for in-person transactions.

Pros

- Available in over 40 countries

- Trusted Apple brand with a strong reputation

- No additional monthly or setup fees

- Well-designed and easy-to-use

- Extremely convenient for Apple device users

Cons

- Limited availability in some countries

- Primarily intended for Apple users

Takeaway

Apple Pay is a great option for businesses offering a seamless payment experience for Apple device users, enhancing convenience and security.

Factors to Consider Before Choosing a WooCommerce Payment Gateway

1. Transaction Fee

Each payment gateway applies different transaction fees every time a card is charged or a purchase is made.

These woocommerce payment gateway fees typically consist of two parts:

- A portion of the exchange. The majority of transaction fees range from 2.5 to 3.5%.

- A nominal charge per transaction. Typically, this costs $0.30.

Although each payment gateway has a unique transaction fee, most are competitive. The specific fee charged will also vary based on the nature of the transaction, such as whether it is made with a chip credit card, an invoice, or another method.

2. Operating Expenses

Unfortunately, you’ll also need to be concerned about other fees. Some payment gateways impose monthly fees, added costs for specific transactions, and other fees.

WooCommerce Payment Gateways Selection

- Ensure compatibility with business type.

- Consider extra charges for recurring or subscription-based payments.

- Avoid high international fees for international sales.

If your customers prefer to pay with checks or cash rather than debit cards, avoid using a service with high offline fees.

3. WooCommerce Compatibility

Things will be much simpler if your payment gateway is compatible with WordPress plugins. For instance, WooCommerce offers plugins for many gateways, including Stripe, PayPal Pro, Square, Authorize.net, and many more.

Long-term, using one of these will greatly simplify life. The setup and maintenance on your end are significantly reduced because these plugins automatically manage the connections between WooCommerce and the respective payment gateways.

Without them, you’ll have to connect the different steps manually, which can be very challenging if you’re unfamiliar with the technology.

Long-term, using one of these will greatly simplify life. The setup and maintenance on your end are significantly reduced because these plugins automatically manage the connection between WooCommerce and their respective payment gateways.

Without them, you’ll have to connect the different steps manually, which can be very challenging if you’re unfamiliar with the technology.

Also read: How to Integrate Paypal Account in WooCommerce

4. Effortless Use

Being an entrepreneur is challenging. Avoid making things more difficult by selecting a payment processor that is challenging to use. Financial services are already extremely complex; there is no need to make them even more so!

It’s well known that some services are simpler to use than others.

5. Type of Payment Gateway

There are several different types of payment gateways. Some require that your customers make payments directly on their secure website, while others will let you display the entire payment process on your own website.

Since it appears more professional, you should generally use a payment gateway on your website. It is not a deal-breaker if your preferred payment gateway does not permit you to do so.

6. Customers’ Payment Alternatives

While some payment gateways only accept credit cards, others also accept bank transfers, Bitcoin, and PayPal. More payment options for your users are better. Accepting as many payment methods as possible is best because some clients can only pay you using particular ones.

There are generally no drawbacks to having a variety of options.

7. Multi-country Support

Geographical Constrained Payment Gateways

- Payment gateways often face geographical restrictions due to legal restrictions.

- The Middle East or Africa may need help with American payment processors.

- Language proficiency of support staff is beneficial for complex technical issues.

- Frustration arises when complex issues are not understood.

8. Currency

Similarly, you must confirm that your payment gateway offers reasonable currency conversion and supports it. Additionally, some gateways charge exorbitant fees for currency transfers, particularly for rare currencies.

Offering it as an alternative is always a great idea because customers prefer to pay in their currency, which will increase sales. It even gives the impression that your store is focused on the global market, which is excellent for your brand’s image.

9. Security

To sum up, security is the most crucial factor in payments. If the payment process isn’t secure, you and your customers are open to data loss and other problems.

That covers issues with technology, finances, and even the law. Thankfully, virtually everyone is secure if you use a payment gateway properly.

The majority make complying with PCI and other local/regional laws simple. Customers must feel confident in you before they will purchase from you. Demonstrating that you have a secure payment system in place can convey that buying from you is secure and dependable.

Best Payment Gateway for WooCommerce: Choose Wisely

Selecting the best payment gateway for WooCommerce store is a pivotal choice that influences both your operational efficiency and customer satisfaction.

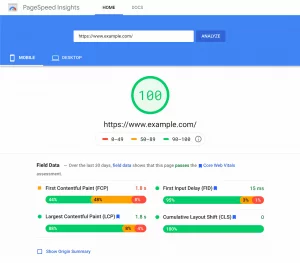

To ensure your WooCommerce store performs at its best, consider partnering with Nestify. Our advanced hosting solutions provide optimized infrastructure, automatic scaling, and top-tier security features, guaranteeing that your store remains robust and responsive even during peak traffic periods.

Let Nestify handle the technical complexities of hosting and performance, and you can concentrate on scaling your business and delighting your customers, confident that the technical backbone of your store is in expert hands. Sign up for the free trial today.

FAQs on WooCommerce Payment Gateways

What is the process of integrating a payment gateway with WooCommerce?

To integrate a payment gateway with WooCommerce, you typically need to:

- Install and activate the appropriate WooCommerce payment gateway plugin.

- Configure the plugin settings with your payment gateway account information.

- Test the integration in a staging environment to ensure everything works correctly.

- Go live with the integration on your production site.

Are there any fees associated with using a payment gateway?

Yes, payment gateways usually charge transaction fees, which can vary based on the provider and the account type. These fees may include a percentage of every transaction and/or a fixed fee per transaction.

How do I ensure the security of payments on my WooCommerce site?

- Use payment gateways that are PCI-DSS compliant.

- Ensure that your ecommerce website has an SSL certificate to encrypt data transmitted between the customer and your site.

- Regularly update your WooCommerce, WordPress, and payment gateway plugins to patch any security vulnerabilities.

How can I test a payment gateway before going live?

Use the sandbox or test mode provided by the payment gateway to simulate transactions without processing real payments. This allows you to test the integration and functionality without financial risk.