Buy-now-pay-later (BNPL) has emerged as a prominent trend in the ecommerce sphere, garnering significant attention. The allure is evident: customers can utilize BNPL platforms to secure products without interest charges, circumventing the need for upfront savings. As a result, numerous merchants are embracing BNPL, integrating it into their checkout systems and reaping its advantages.

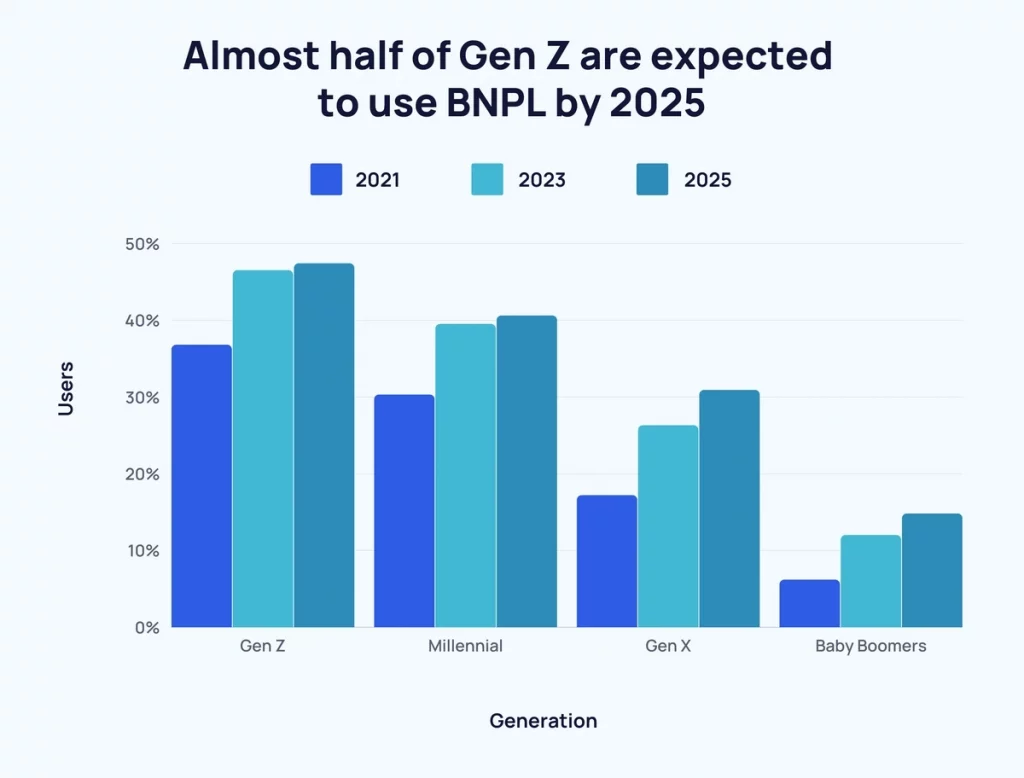

A striking 67% of BNPL users foresee the potential for these platforms to supplant traditional credit cards in the coming years. Consequently, it becomes imperative for ecommerce stores to consider incorporating this option into their repertoire to capitalize on this burgeoning trend. The pressing question, however, is: which platform stands out as the optimal choice?

What is a Buy-Now-Pay-Later (BNPL) Platform?

Buy-now-pay-later (BNPL) has emerged as a hot topic in the ecommerce landscape, drawing significant attention for its growing popularity. Its appeal lies in its simplicity: customers can leverage BNPL platforms to make interest-free payments and acquire products they’d otherwise save up for. This trend has led many merchants to integrate BNPL into their checkout systems, reaping its rewards.

An overwhelming 67% of BNPL users anticipate these platforms potentially overtaking traditional credit cards in the near future. Hence, it becomes essential for ecommerce stores to consider incorporating this option to leverage the trend’s potential. However, the pressing question remains: which platform holds the edge? That’s precisely what I aim to uncover in this article.

Benefits of BNPL:

Source: Exploding Topics

- Financial Flexibility: BNPL offers customers the convenience of spreading payments without incurring interest, enabling easier access to desired products.

- Enhanced Conversion Rates: By providing BNPL options, merchants can attract more customers who prefer flexible payment methods, potentially boosting sales.

- Customer Attraction and Retention: Offering BNPL can attract new customers and foster loyalty among existing ones, enhancing overall customer satisfaction.

- Competitive Edge: Ecommerce stores that adopt BNPL stay ahead of the curve, catering to evolving customer preferences and staying competitive in the market.

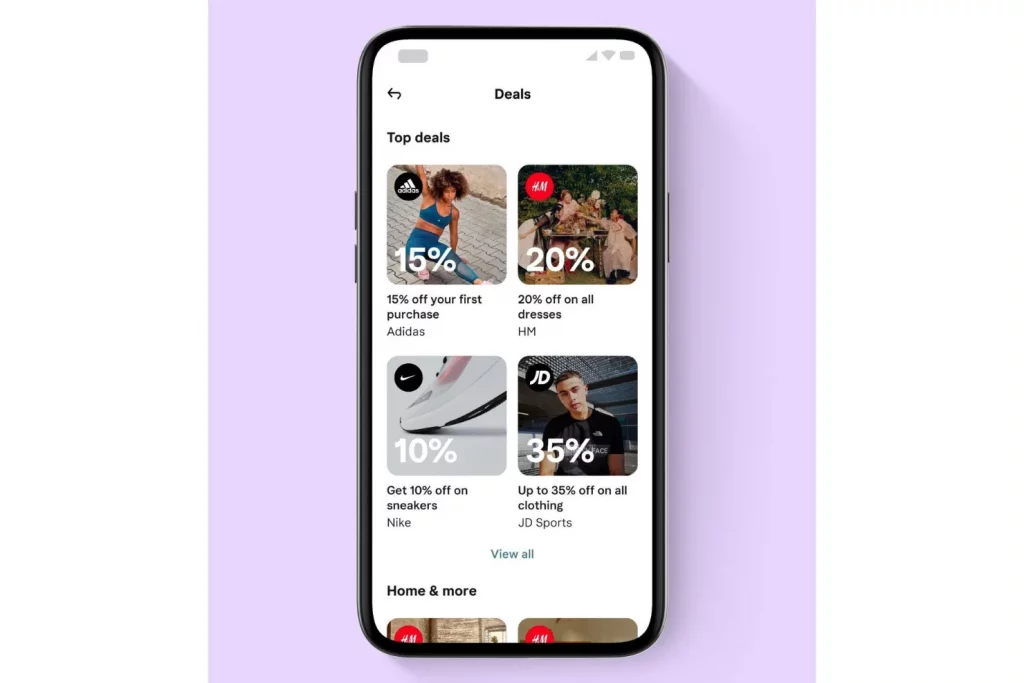

TOP BNPL for Ecommerce:

1. Paypal’s “Pay-in-Four”

PayPal’s “Pay-in-Four” Buy Now, Pay Later (BNPL) platform extends its capabilities to merchants already using PayPal Pay, offering customers alternative payment choices.

Reasons for Choosing PayPal’s “Pay-in-Four”: PayPal stands out as a widely trusted and secure payment system, now venturing into the BNPL domain. Leveraging their global credibility, it can convert skeptical individuals into paying customers. For merchants already accepting PayPal, integrating the Pay-in-Four system is straightforward.

PayPal’s “Pay-in-Four” adapts seamlessly to businesses of all sizes, empowering them to offer diverse financing options to customers. Implementing this involves adding a Pay Later button to the checkout system, enabling existing PayPal users to apply for financing on purchases ranging from $30 to $1,500.

Key Features and Integrations of PayPal’s “Pay-in-Four”

Features encompass business insights, robust reporting, automated updates, debit and credit card processing, POS system, recurring payments, purchase protection, invoice management, and online checkout.

Integration options span platforms like BigCommerce, Wix, WooCommerce, GoDaddy, Adobe, Shift4Shop, XCart, Miva, Volusion, OpenCart, Cart.com, and Vortx.

For existing PayPal merchants, “Pay-in-Four” is a complimentary add-on. Transaction fees on the platform amount to the regular 3.49% + $0.49/transaction

Pros

- No additional expenses

- User-friendly interface

- Streamlined organization

Cons

- Redirects customers away from your site

- Higher interest rates for customers

2. Sezzle

Sezzle offers transparent services aimed at empowering your customers to make informed purchasing decisions and establish credit.

Reasons for Choosing Sezzle: Sezzle stands out by providing customers with transparency and financial education, enabling you to empower your target audience. It offers opportunities for customers to avoid late fees and enables younger shoppers to build credit through the Sezzle Up program. This program reports customers’ timely installment payments to credit bureaus, aiding in credit-building efforts.

Sezzle presents a straightforward Buy Now, Pay Later (BNPL) solution to your customers, primarily through a single payment plan: the 4-pay plan. This plan involves a 25% down payment upon order placement, followed by three subsequent payments, with all payments required to be completed within six weeks.

Key Features and Integrations of Sezzle

Features encompass credit and debit card processing, credit bureau reporting, payment rescheduling, and interest-bearing savings accounts.

Integration options span platforms like Shopify, CommentSold, WooCommerce, Magento, BigCommerce, Littledata, 3dcart, ResponseCRM, Cybersource, BuyItLive, and Salesforce Commerce Cloud.

Sezzle offers tailored pricing upon request.

Pros

- Attracts customers effectively

- Simple setup process

- High customer approval rates

Cons

- Challenges with customer support

- Potential for high fees

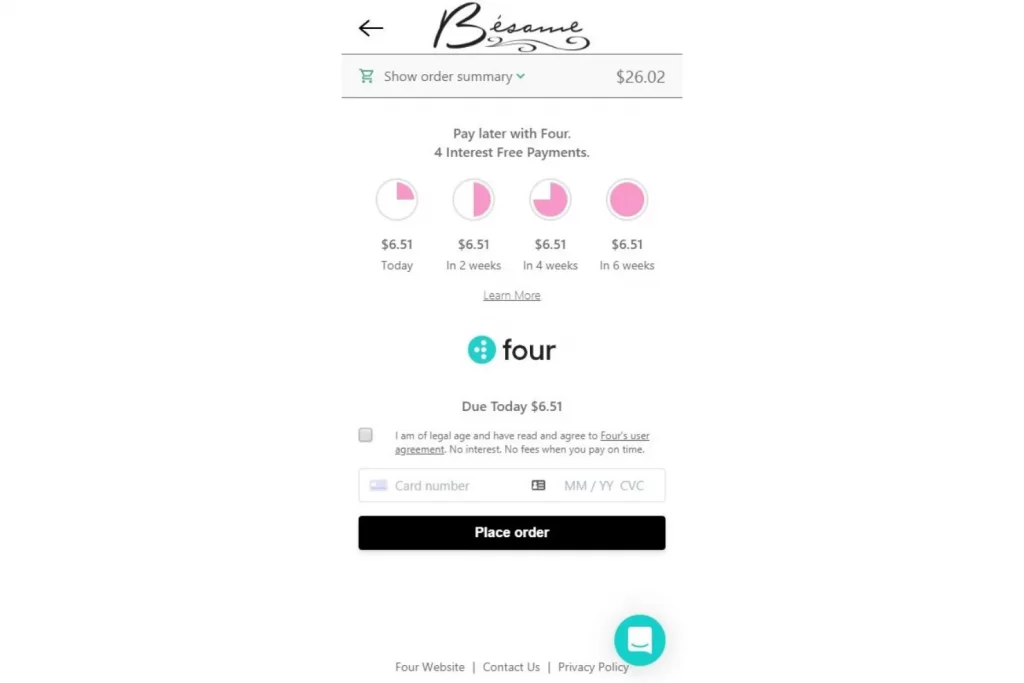

3. Four

Four facilitates businesses in expanding their customer reach by integrating with alternative payment applications like Google and Apple Pay.

Reasons for Choosing Four: The platform streamlines the purchase journey for customers by enabling a seamless checkout process within your website, eliminating the need for customers to navigate away to complete purchases. This strategy fosters enhanced customer loyalty and reduces cart abandonment rates. With integrations to various digital wallets such as Google and Apple Pay, Four significantly minimizes friction points during the purchasing phase.

Notably, Four’s approach doesn’t mandate customers to undergo credit checks for product purchases, providing instant decisions. The platform allows customization of widgets and checkouts, ensuring brand-aligned themes for a cohesive customer experience.

Key Features and Integrations of Four

Features encompass one-click checkout, a shopper portal, swift integration, customizable interface, order and refund management, order tracking, customer spending analytics, and flexible payment processing.

Integrations span platforms like WooCommerce, Shopify, and Shopify Plus.

Four offers personalized pricing upon request and provides a free demo to assist in evaluating the platform’s suitability.

Pros

- Enhanced conversion rates

- Seamless integration with Shopify

- Effortless order tracking

Cons

- Opportunities for customer service improvement

Learn about ecommerce trends for 2024 here.

4. Klarna

Klarna provides diverse Buy Now, Pay Later (BNPL) options tailored for fashion and luxury brands.

Reasons for Choosing Klarna: The platform resonates particularly well with younger generations frequenting fashion and luxury brands. This is attributed to Klarna’s “Pay in 30 Days” financing option, allowing customers to trial items, retain what they like, and return unwanted items within 30 days. This approach offers a low-pressure shopping experience, prompting customers to finalize their orders.

Klarna further empowers merchants by offering express checkout alternatives on product pages, facilitating a streamlined, one-click checkout process. However, employing this feature incurs an additional fee for businesses. Yet, it can be a worthwhile investment, reducing customers’ decision-making time and expediting their purchase process.

Key Features and Integrations of Klarna

Features include fraud protection, upfront payments, global solutions, seller safeguards, automated updates, advertising tools, product search, order management, reporting analytics, and a dedicated merchant portal.

Klarna seamlessly integrates with LogiCommerce, Desktop.com, Shopaccino, PremierCashier, Happy Returns, Cloud Funnels, 29 Next, Elixir, SendOwl, Centra, BetterCommerce, and Adyen.

Klarna offers tailored pricing upon request.

Pros

- Strong brand recognition

- Multiple checkout options

- No loan constraints

Cons

- High late fees for customers

- Perceived shortcomings in customer service

5. Splitit

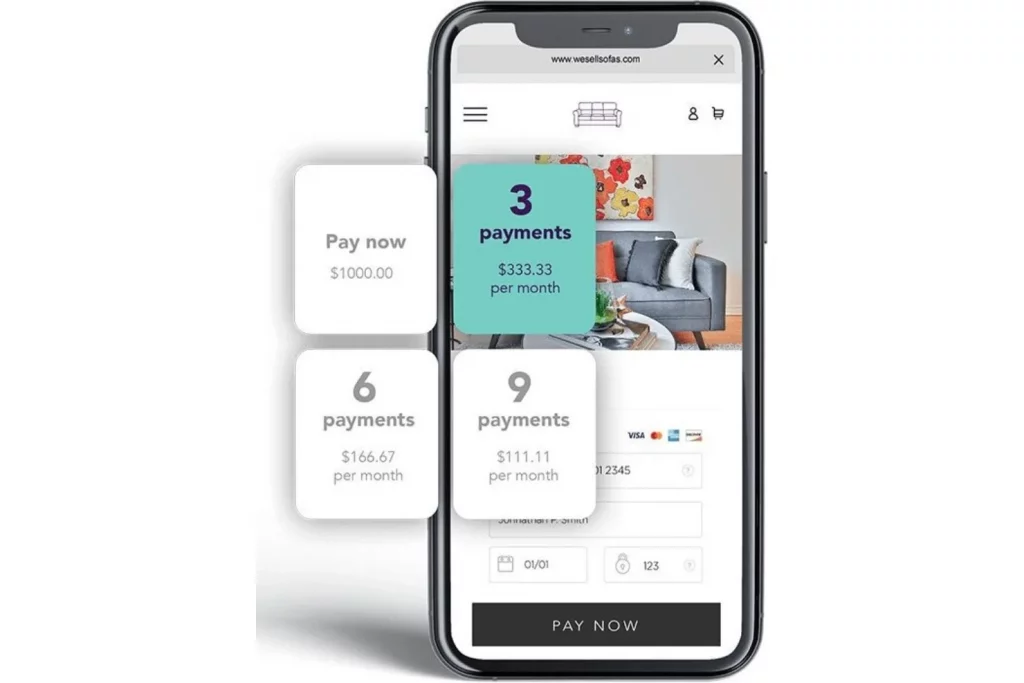

Splitit enables ecommerce businesses to offer installment payment plans to customers directly from their websites.

Reasons for Choosing Splitit: The platform stands out by offering white-label features that empower businesses to oversee the entire purchase journey, placing their brand at the forefront. This approach enhances brand loyalty by maintaining a seamless brand experience throughout the buy-now-pay-later process, seamlessly integrated on the business’s website.

Splitit preserves the customer relationship by abstaining from cross-selling; customers remain solely affiliated with the business, fostering greater control over customizing the customer experience. Businesses using Splitit can tailor payment frequency and down payment requirements according to their preferences. Moreover, Splitit authorizes the full purchase amount on the customer’s credit card, reserving the balance until the final payment.

Key Features and Integrations of Splitit

Features encompass PCI compliance, robust reporting and analytics, in-person payments, and comprehensive debit and credit card processing.

Splitit seamlessly integrates with platforms such as Shopify, PayPal, WooCommerce, BlueSnap, Magento, BigCommerce, PrestaShop, Authorize.net, WorldPay, Adyen, and Wix.

Splitit’s pricing starts at 1.5% per transaction plus an additional $1.50 per installment, invoiced monthly to the business.

Pros

- Low merchant fees

- User-friendly setup

- Intuitive dashboard

Cons

- Customers need available credit beforehand

- Challenges may arise with foreign banks

6. Affirm

Affirm empowers your business by providing flexible payment options across various platforms where customers shop for your products.

Reasons for Choosing Affirm: This platform caters to diverse transaction types, including ecommerce, in-store, and telesales, earning recognition as Amazon’s preferred choice for Buy Now, Pay Later (BNPL) solutions. Affirm seamlessly integrates buy-now-pay-later functionalities across all customer touchpoints, from product pages to checkout, simplifying the purchasing process for customers.

Retailers using Affirm gain complete control over installment qualifications, including the option to offer 0% interest financing, customize payment messaging placement, and define payment duration. With its Adaptive Checkout tool, Affirm dynamically updates customers’ loan repayment options in real time, allowing them to view personalized installment amounts as they shop across the site.

Key Features and Integrations of Affirm

Features encompass a business portal, credit card and ACH payment processing, activity dashboard, mobile payment support, billing and invoicing tools, a mobile app, and real-time analytics.

Affirm integrates seamlessly with platforms like Wix, Shopify, WooCommerce, Magento, BigCommerce, OpenCart, 3dcart, NetSuite SuiteCommerce, AmeriCommerce, Volusion, Web Shop Manager, PlanetScale, and Lightspeed eCommerce.

Affirm offers customized pricing upon request.

Pros

- No customer late fees

- Generous customer purchase limits

- User-friendly dashboard

Cons

- Competitive rates may vary

- Limited to the USA market

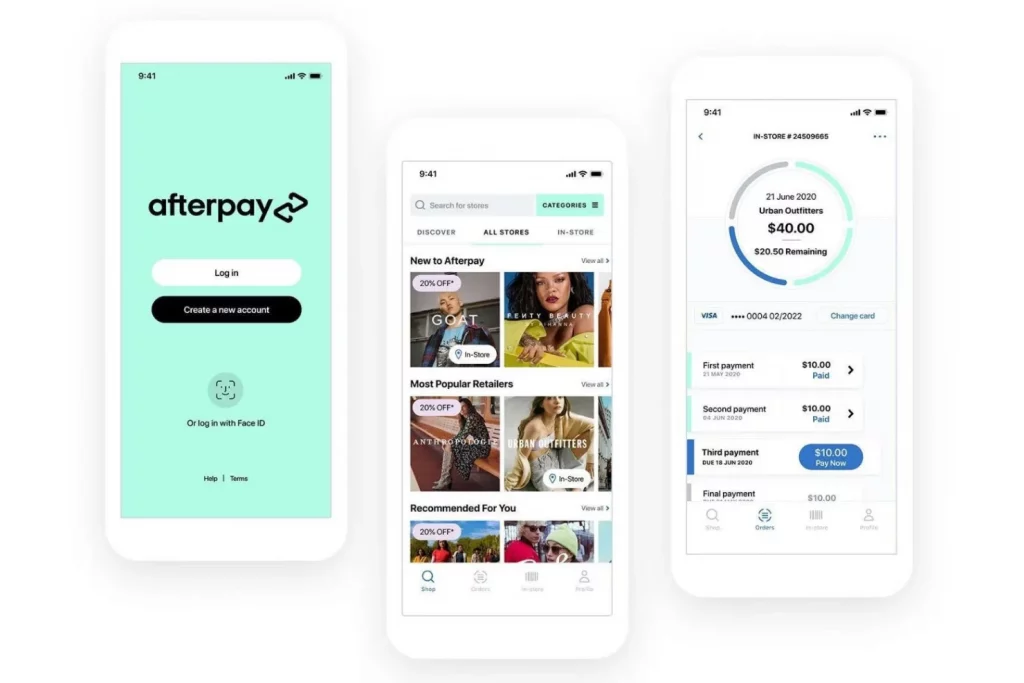

7. Afterpay

Afterpay extends a credit limit to your customers for making purchases on your ecommerce store while incentivizing responsible spending through rewards.

Reasons for Choosing Afterpay: The platform initiates with sensible and transparent spending credit limits for new Afterpay users, gradually increasing these limits for timely payments. It also provides guidance to assist customers in practicing responsible spending habits.

Afterpay caters to retailers operating both online and in-store, offering seamless integration with Square for BNPL options directly from a Square POS system. Additionally, Afterpay facilitates the acquisition of a marketing kit to notify customers about the acceptance of Afterpay as a payment method.

Key Features and Integrations of Afterpay

Features encompass ACH payment processing, fraud detection, electronic and mobile payments, data security, credit card processing, subscription billing, and comprehensive transaction history.

Afterpay integrates effortlessly with platforms like Ecwid, CS-Cart, Shopify, Wix, WooCommerce, Synder, Magento, BigCommerce, Cloud Funnels, Propeller, BridgerPay, and Salesforce Commerce Cloud.

Afterpay provides customized pricing upon request.

Pros

- User-friendly interface

- No customer credit checks

- Strong merchant support

Cons

- Potential for retailer denial

- High interest rates on late payments

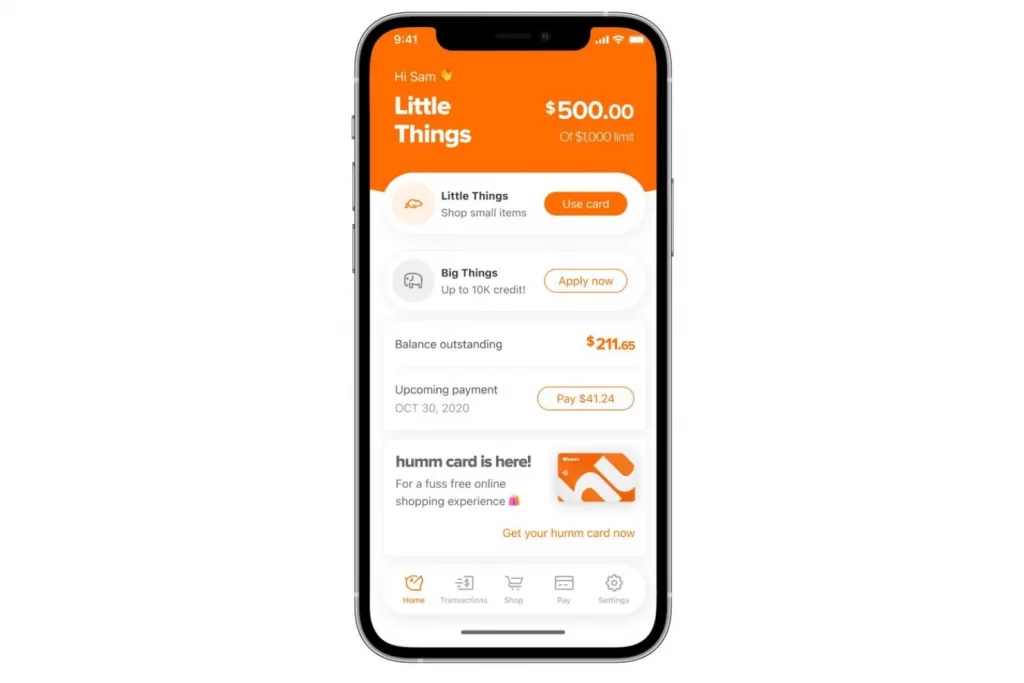

8. Humm

Humm, a Buy Now, Pay Later (BNPL) platform, facilitates customers in breaking down substantial purchases.

Reasons for Choosing Humm: As described on the Humm website, this BNPL service is tailored for enabling customers to make significant purchases, allowing them to divide payments for items valued up to $30,000. Customers have the flexibility to spread these payments across five or ten installments every two weeks or opt for extended payment plans of up to 60 months for larger acquisitions.

Humm ensures prompt settlement of payments with businesses, typically the next business day, a valuable aspect for smaller businesses reliant on these payments. Additionally, if customers return items, Humm refunds their associated fees.

Key Features and Integrations of Humm

Features encompass flexible repayment options, soft credit checks, and seamless online and in-store purchase processing.

Humm seamlessly integrates with platforms like Salesforce, Shopify, WooCommerce, Magento, Striven POS, PrestaShop, OpenCart, Kitomba, Retail Directions, Shopify Plus, Intershop, and eStar.

Humm offers tailored pricing upon request.

Pros

- Facilitates large purchases

- Direct REST API

- Streamlined sign-up process

Cons

- Customer support requires improvement

- Relatively high customer fees

9. Sunbit

Sunbit facilitates the breakdown of payments for essential services offered to customers.

Reasons for Choosing Sunbit: Distinguishing itself from platforms focusing on nonessential item merchants, Sunbit specializes in providing installment options for in-person services like car repairs, eye exams, or veterinary care. It aids in easing the financial strain for customers availing essential services and provides businesses with a competitive edge by extending services to individuals with varying credit standings.

Sunbit primarily supports businesses offering essential services, making them more accessible and affordable. Through this platform, businesses can enable customers to pay for services, up to $10,000, over a 3-to-12-month installment period.

Sunbit’s Standout Features

Features encompass high approval rates, a swift application process, dedicated partner success support, access to digital marketing resources, and actionable insights.

Sunbit offers personalized pricing upon request and provides a free demo.

Pros

- User-friendly interface

- Tailored for in-person businesses

- Comprehensive omnichannel solution

Cons

- Costs revealed upon application

- Requires an initial down payment

10. Wisetack

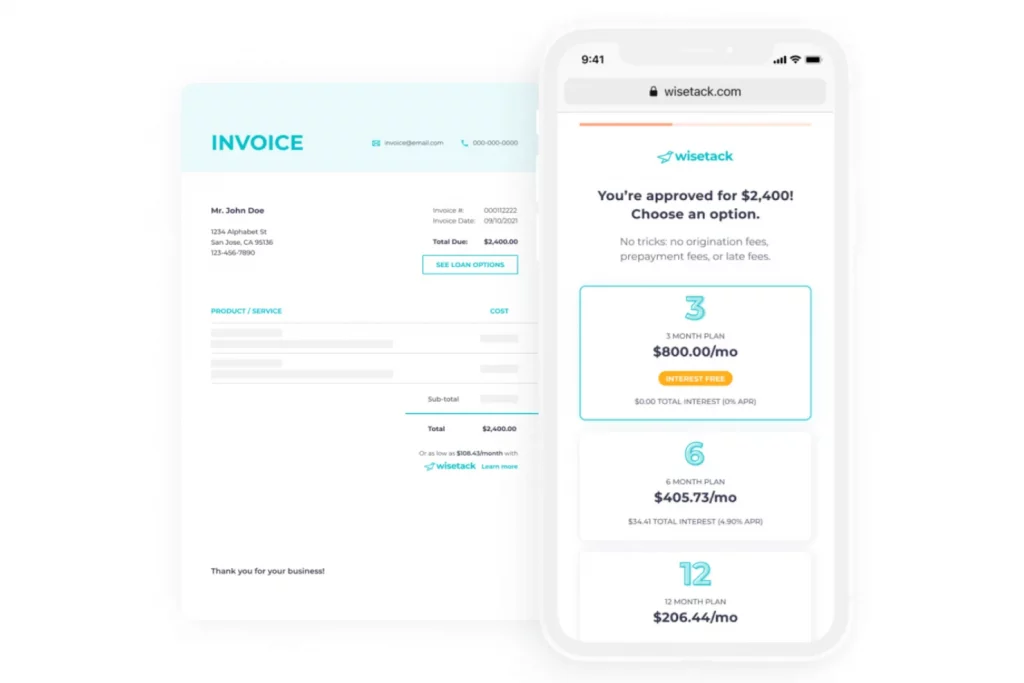

Wisetack empowers businesses to offer customers transparent payment alternatives, particularly for subscription-based products and services.

Reasons for Choosing Wisetack: Wisetack seamlessly integrates into your existing website and checkout system, allowing businesses to provide customers with installment payment options, especially suited for services like subscription boxes or streaming platforms. Their BNPL (Buy Now, Pay Later) solution enables ecommerce ventures to offer customers the choice of paying for their purchases in convenient installments rather than a lump sum, potentially fostering greater customer loyalty and increased sales.

Wisetack’s BNPL solution not only benefits customers but also offers advantages to businesses. It helps curtail cart abandonment, enhancing cash flow, as customers are more likely to complete purchases when offered installment payment choices. Moreover, Wisetack’s BNPL furnishes businesses with crucial insights into customer spending habits, aiding in informed decisions regarding inventory management, marketing strategies, and overall business operations. Ultimately, Wisetack’s BNPL can serve as a valuable resource for ecommerce businesses seeking sales growth, customer retention, and overall financial improvement.

Wisetack’s Key Features and Integrations

Features encompass consumer financing, swift customer approvals, debit and credit card processing, and immediate payments.

Integrations involve an API that seamlessly integrates with your current systems.

Wisetack tailors pricing upon request. Unfortunately, Wisetack does not offer information about a free trial.

Pros

- Streamlined coordination with the vendor

- Effortless integration capabilities

- Control over payment terms

Cons

- Potential for high fees

- Delay in receiving funds

Criteria for Evaluating BNPL Platforms:

- Ease of Use: The focus is on platforms that streamline the purchasing process for customers, reducing cart abandonment. An emphasis is placed on quick, hassle-free transactions that reassure customers they don’t need to pay the total amount upfront.

- Customization: Preference is given to platforms offering various buy-now-pay-later options beyond the standard “Pay in 4” method. Flexibility in payment terms, ranging from weeks to months, is a key consideration.

- Cost to Customers: Understanding the potential fees associated with missed payments is essential. While BNPL installments are often interest-free, the assessment involves examining penalties for late payments, reopening accounts, or monthly charges.

- Software Integrations: Ease of integration into different ecommerce systems is crucial. Favor is directed towards BNPL platforms with straightforward processes and robust customer support to aid businesses in implementation, irrespective of their existing ecommerce platform.

- Pricing: Evaluation involves examining the percentage fee deducted by the BNPL vendor per transaction. Platforms charging fees typically ranging from 2% to 8% are preferred. Additionally, consideration is given to the customer-facing costs such as late fees for missed payments.

Conclusion:

In the pursuit of identifying the most suitable BNPL (Buy Now, Pay Later) platforms, the central focus has been on ensuring a seamless user experience, offering a diverse array of payment choices, carefully considering the cost to customers, facilitating smooth integrations with existing ecommerce systems, and establishing transparent pricing structures.

FAQs on BNPL:

Do BNPL platforms perform credit checks on customers?

While some BNPL platforms conduct soft credit checks that don’t impact credit scores, others may run a more detailed check. This can vary, so it’s advisable to review the platform’s policies.

Are there restrictions on what products or services can be bought using BNPL?

BNPL platforms often have guidelines regarding the type of purchases allowed. Some might limit certain categories like gambling, cryptocurrency, or financial products. Checking the platform’s terms is crucial for clarity.

Can customers use multiple BNPL platforms simultaneously for different purchases?

Yes, customers can use different BNPL platforms for separate purchases, but managing multiple installment plans concurrently requires careful financial planning to avoid potential payment issues.

What happens if there’s a dispute or issue with a purchase made through a BNPL platform?

BNPL platforms usually offer customer support to address disputes or issues. They may assist in mediating conflicts between customers and merchants according to their policies and terms.