By addressing return fraud proactively and adopting a holistic approach to security, businesses can navigate the complex landscape of fraud risks and emerge stronger, more resilient, and better equipped to thrive in an evolving digital environment.

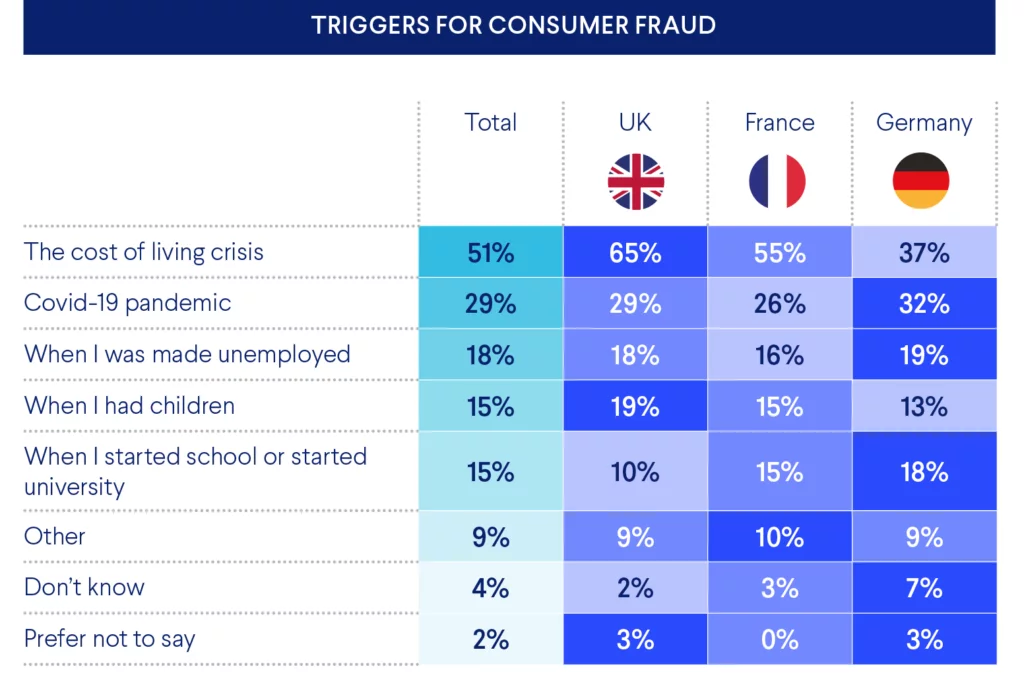

Consumer attitudes towards refunds and returns have undergone a noticeable shift, bringing about a surge in refund and its repercussions.

According to Thomas S. Robertson, a researcher specializing in competitive behavior, the modern consumer often makes their purchase decision not at the store, but in the comfort of their home. This means that the choice to keep or return an item is frequently made long after the purchase has been made.

While this shift in behavior may offer convenience to consumers, it poses significant challenges for merchants, impacting their profitability. Consequently, it is the fraud teams within these businesses who bear the responsibility of managing and mitigating the effects of refund abuse.

What exactly constitutes refund abuse?

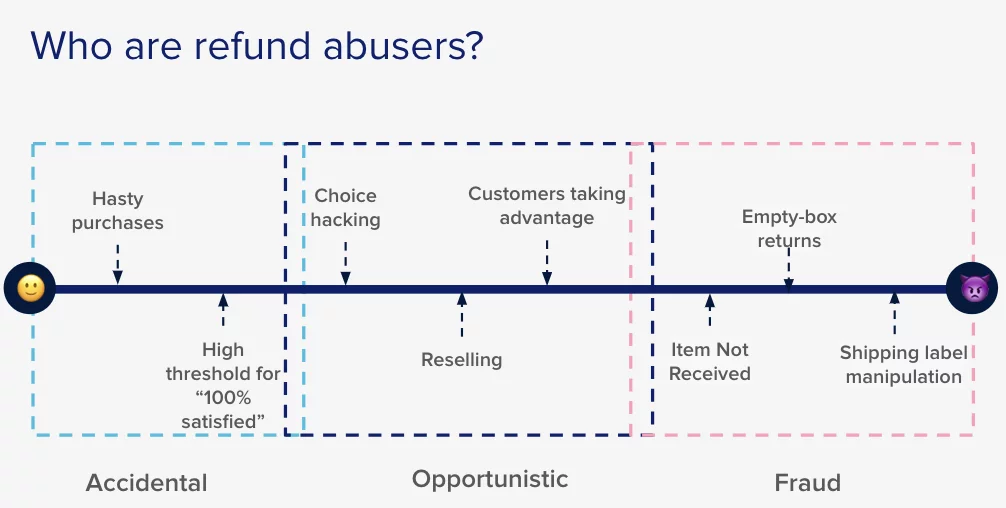

Refund abuse, also referred to as returns abuse, occurs when a customer seeks and obtains a refund for a purchase they assert was incomplete or unsatisfactory. Essentially, they exploit the merchant’s returns policy and goodwill for their own gain.

Refund abuse can manifest as either opportunistic or premeditated behavior, both of which pose significant challenges for merchants.

It’s important to differentiate between refunds and chargebacks, as they serve distinct purposes. Deceptive chargebacks, where the cardholder misrepresents the transaction, differ from deceitful refund requests and are prevented in different ways.

Learn about returns management here.

What qualifies as a malicious refund?

A malicious refund involves a customer misrepresenting the truth to acquire money, store credit, or free items through a refund request. This request may or may not be accompanied by the return of an item.

Handling refund requests is an integral aspect of being a merchant. Average ecommerce return rates hover around 16.5%, with the US alone witnessing $231 billion worth of returned merchandise in 2023.

However, the prevalence and ease of returns in an online economy create opportunities for abuse and fraud, particularly when merchants haven’t developed strategic measures to address these issues.

Is return fraud synonymous with refund fraud?

While they often intersect, return fraud and refund fraud are not interchangeable. Return fraud encompasses any fraudulent activity involving the return of an item, whereas refund fraud involves any deceptive activity related to refund requests.

It’s entirely plausible for a fraudulent scheme centered around refund requests to not involve any returns, and vice versa. For instance, an opportunistic individual may claim they never received an item they actually did receive and request a refund for their purchase.

Conversely, someone might falsely claim non-receipt of their item to have a duplicate sent to them, intending to resell both items despite only paying for one. In this scenario, return fraud is committed even though the scheme does not entail a refund.

Types of Return Fraud and Refund Abuse:

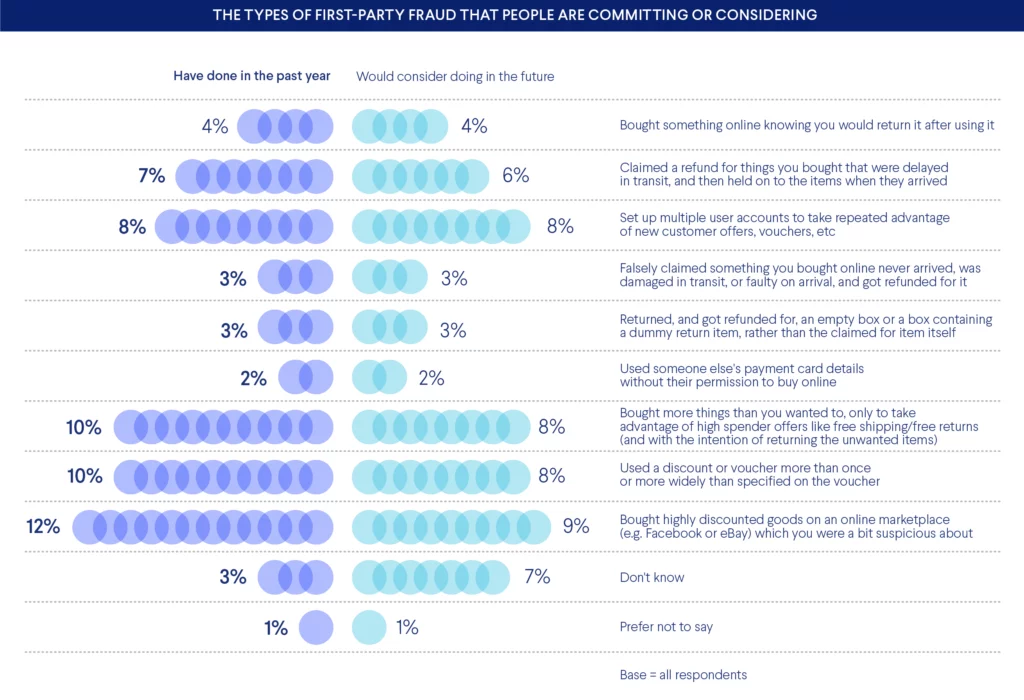

Fraud and exploitation associated with returns and refunds come in various forms, each posing challenges for merchants. Here are some common types:

- Wardrobing: This occurs when consumers purchase items with the intent to wear them once and then return them for a full refund. It is more prevalent in high-end apparel retailers.

- Item-Not-Received Fraud: Customers falsely claim that they never received the item(s) they ordered, either to obtain a refund or to receive a duplicate shipment, resulting in double goods.

- Empty Boxing: Fraudsters return packages either empty or filled with unrelated items, hoping to secure a refund before the discrepancy is detected.

- Bricking: Common in consumer electronics, this involves deliberately damaging a device to render it unusable, then returning it for a refund without disclosing the damage.

- Price Arbitrage: Scammers return a similar but lower-priced item, yet request a refund based on the higher-priced item they initially purchased.

- Receipt Fraud: This occurs when fraudsters tamper with original receipts to manipulate refund amounts, often attempting to receive more money than they initially paid.

- Fake Return: Any instance where the returned items are not the original purchases or have been tampered with falls under this category. Empty boxing is a subset of fake returns.

- Shoplifted Returns: Involves stealing items from physical stores and then returning them—either online or in-store—for store credit or cash refunds.

- Money Laundering: Criminals exploit refunds to launder money by purchasing items and then returning them to receive clean funds.

- Dry Ice Returns: Fraudsters return packages containing dry ice, which evaporates during transit, making it challenging for merchants to dispute the refund request.

- Refund Fraud-as-a-Service: Some fraud rings offer refund fraud services for hire, assisting individuals in executing refund scams for a share of the proceeds.

The Financial Impact of Return Fraud on Businesses

Return fraud poses significant financial risks to sellers and can severely damage a brand’s reputation. While calculating the exact cost of return fraud is challenging due to its complex nature, it is undoubtedly substantial. Here are some estimates highlighting the potential financial losses incurred by businesses due to return fraud:

- Annual Losses: U.S. retailers experience staggering losses of approximately USD 18.4 billion annually due to merchandise return fraud alone. When combined with return abuse, the total estimated losses soar to USD 24 billion.

- Wardrobing: Nearly 50% of return fraud instances involve “wardrobing,” where customers essentially engage in free renting by returning non-defective items after using them once.

- Return Fraud Without Receipts: Approximately 21% of returns made without a receipt are fraudulent, further exacerbating the financial impact on businesses.

- Online Sales: With the surge in digital transactions, 38% of merchants have reported an increase in online sales. Unfortunately, this digital shift has also led to a corresponding rise in fraudulent returns, with 29% of merchants experiencing such incidents.

- Reverse Logistics Costs: More than 10% of a business’s revenue is allocated towards reverse logistics, which includes managing items fraudulently returned by customers. These costs further contribute to the overall financial burden imposed by return fraud.

Best Practices to Combat Return Frauds:

A. Refine Your Return Policy: Crafting a Customer-Centric Approach

Crafting and refining your return policy is a crucial aspect of ensuring customer satisfaction and managing expectations. A well-designed policy strikes a balance between being clear and accommodating to various scenarios. Here are key considerations to fine-tune your return policy:

- Clearly Defined Expectations:Clearly outline the conditions under which merchandise can be returned. Specify requirements such as unopened packaging, intact tags, and inclusion of the original invoice. This clarity helps customers understand what is expected of them when initiating a return.

- Time Limits:Establish reasonable time limits for returns, typically within 90 days for online purchases. However, be flexible and considerate of the product category and customer circumstances when setting timeframes.

- Return Shipping Instructions:Provide clear instructions for return shipping, especially for card-not-present purchases. Specify acceptable carriers, packaging guidelines, and any insurance requirements. This ensures that returns are processed efficiently and securely.

- Fee Structure:Transparently communicate any associated fees with returns, such as restocking fees. Clarify who is responsible for return shipping costs and whether return labels are provided upon request. Customers appreciate knowing the potential costs involved in returning merchandise.

- Exceptions:Identify any exceptions to your standard return policy, particularly for customized or non-standard items. Clearly communicate these exceptions to customers before completing the sale to avoid misunderstandings.

- Special Circumstances:Acknowledge and accommodate special circumstances that may affect the return process. Consider factors like product category, location, currency, or customer demographics when determining return policies. International customers, for instance, may require extended return periods due to shipping logistics.

B. Ensuring Accessibility: Making Your Return Policy Easily Available

Crafting a transparent return policy is just the first step; ensuring its accessibility is equally vital. Here’s why making your policy easily available is crucial and how you can achieve it:

- Customer Expectations:Over two-thirds of online shoppers review return policies before making a purchase. If your policy is challenging to find or comprehend, it could deter potential buyers. By making your policy readily accessible, you align with customer expectations and instill confidence in their shopping experience.

- Prominent Display:Your return policy should be prominently featured across various touchpoints. It should be visible on every page of your website, including product pages and the checkout process. Additionally, display it on invoices, receipts, and packaging to ensure customers have multiple opportunities to review it.

- Simplified Language:Ensure that your return policy is written in clear and concise language that is easy for customers to understand. Avoid complex legal jargon that may confuse or intimidate shoppers. Use bullet points or numbered lists to outline key terms and conditions for clarity.

- Mobile Optimization:With the increasing prevalence of mobile shopping, optimize your return policy for mobile devices. Ensure that it is easily accessible and readable on smartphones and tablets, allowing customers to review it seamlessly regardless of the device they use.

- FAQ Section:Include a dedicated FAQ section on your website that addresses common questions about returns and refunds. This section can provide additional clarity and guidance to customers, reducing the need for them to seek assistance from customer support.

C. Leveraging Historical Data: Identifying Suspicious Activity

Analyzing historical data is essential for detecting and preventing return fraud. Here’s how historical data can help:

- Swift Detection:By maintaining detailed records of past transactions and return requests, you can quickly identify suspicious patterns or anomalies. This proactive approach allows you to detect potential return fraudsters before they impact your business.

- Comparison Analysis:Compare cardholder information, return request details, dates, and locations against historical data to identify inconsistencies or irregularities. This comparative analysis helps flag fraudulent activities and protect your business from financial losses.

- Product Insights:Analyzing historical data can also reveal which products or items are frequently targeted by return fraudsters. This insight enables you to implement targeted measures, such as enhanced security measures or stricter return policies, for high-risk products.

D. Be Adaptive: Balancing Firmness with Flexibility

A well-crafted return policy strikes a delicate balance between firmness and flexibility. Here’s why being flexible can strengthen your brand and foster customer loyalty:

- Addressing Special Cases:Occasionally, customers may miss return deadlines or encounter unforeseen circumstances. By showing flexibility in such situations, you demonstrate empathy and a commitment to customer satisfaction. This can leave a positive impression on customers and encourage repeat business.

- Building Brand Equity:Flexibility in your return policy enhances brand equity by signaling that you prioritize customer experience over strict adherence to rules. Customers appreciate businesses that are willing to accommodate their needs and are more likely to view your brand favorably as a result.

- Mitigating Friendly Fraud:Friendly fraud often occurs due to convenience, with customers exploiting lenient return policies for personal gain. By implementing flexible yet reasonable return policies, you remove the incentive for customers to engage in fraudulent chargebacks, thereby reducing the risk of friendly fraud.

- Enhancing Customer Satisfaction:Offering flexibility in returns fosters a positive shopping experience and enhances overall customer satisfaction. Customers feel valued and supported when they encounter understanding and flexibility from businesses, leading to stronger customer relationships and loyalty.

E. Cutting Down on Cash Refunds: Deterring Fraudulent Activities

Cash refunds present an opportunity for fraudsters, as they provide immediate monetary gain without the need for traceable transactions. Here’s how you can minimize the risk associated with cash refunds:

- Offer Store Credit:Substitute cash refunds with store credit or exchanges, especially for transactions made in cash. By incentivizing store credit over cash refunds, you discourage fraudulent individuals seeking quick monetary returns.

- Encourage Exchanges:Transform returns into opportunities by encouraging customers to exchange items for store credit instead of opting for cash refunds. Consider offering additional incentives, such as bonus store credit or discounts, to incentivize exchanges and drive future sales.This approach not only reduces the likelihood of return fraud but also promotes customer engagement and repeat purchases, benefiting both your business and your customers.

F. Implement ID Verification for Returns

A staggering majority of return fraud cases occur without a receipt, emphasizing the importance of receipt verification in fraud prevention. By requiring identification alongside receipts, businesses can significantly deter fraudulent returns. Here’s how:

- Strengthen Verification:Require customers to present photo identification along with the original payment card used for in-store returns. For online returns, requesting address details, zip code information, and the last four digits of the payment card enhances verification measures.

- Enhance Security:Requiring ID verification adds an extra layer of security, ensuring that the individual processing the return matches the original purchaser. This measure helps mitigate fraudulent attempts to exploit lenient return policies.

- Customer Cooperation:While some customers may perceive ID verification as an inconvenience, emphasizing its role in fraud prevention can help garner understanding and cooperation. Clear communication regarding the necessity of ID verification can encourage compliance from legitimate customers.

G. Uphold Return Policy Integrity

A return policy is only effective when consistently enforced. To maintain the integrity of your return policy and deter fraudulent activities, consider the following measures:

- Employee Training:Educate your staff on the specifics of your return policy and equip them with the knowledge and tools to enforce it effectively. Ensure that all employees are trained to handle return transactions in accordance with established policies and procedures.

- Transparent Communication:Clearly communicate your return policy terms to customers at the point of purchase. Whether in-store or online, provide a concise overview of the policy highlights during checkout. Require customers to acknowledge the policy before completing their purchase online, reinforcing its non-negotiable nature.

- Balanced Flexibility:While flexibility is valuable in certain situations, maintaining firm and consistent policies is essential for fraud prevention. Strike a balance between accommodating legitimate customer needs and upholding the integrity of your return policy.

H. Seek Expert Consultation

If you’re feeling overwhelmed by the complexity of return fraud prevention, seeking guidance from industry experts can provide valuable insights and solutions tailored to your specific challenges. Here’s why consulting with professionals can make a difference:

- Customized Strategies:Industry experts, like Chargebacks911®, specialize in creating customized chargeback management strategies tailored to your business’s unique requirements. By understanding your specific vulnerabilities and objectives, they can develop targeted solutions to combat return fraud effectively.

- Comprehensive Solutions:Expert consultants offer a range of comprehensive solutions designed to address various aspects of return fraud, including friendly fraud and other threats. From proactive fraud detection to chargeback mitigation strategies, they provide holistic approaches to safeguard your business interests.

- Access to Advanced Tools:Leveraging advanced tools and technologies, industry experts deploy sophisticated fraud detection and prevention measures to mitigate risks effectively. By harnessing the power of cutting-edge software and analytics, they empower businesses to stay ahead of evolving fraud tactics.

- Reputation Protection:Collaborating with reputable consultants enhances your credibility and reputation within the industry. By demonstrating a proactive approach to fraud prevention, you instill confidence in banks, credit card networks, and customers alike, reinforcing your commitment to security and integrity.

Conclusion:

Return fraud poses significant challenges for businesses, impacting financial stability, brand reputation, and customer trust. However, by implementing proactive measures and leveraging advanced tools, merchants can effectively mitigate risks and safeguard their operations. It’s essential to develop clear return policies, invest in fraud detection software, and seek expert consultation to combat fraudulent activities successfully. By prioritizing fraud prevention and adopting a multi-layered approach, businesses can minimize losses, preserve profitability, and enhance customer satisfaction.

FAQs on Return Frauds:

Why is it important to address return fraud promptly?

Addressing return fraud promptly is crucial to minimize financial losses, mitigate reputational risks, and maintain customer trust. Timely intervention can prevent fraudulent activities from escalating and help businesses preserve their bottom line while enhancing overall security measures.

How can businesses adapt to evolving fraud tactics?

Businesses should stay vigilant and continuously monitor emerging fraud trends and tactics. By leveraging data analytics, machine learning, and artificial intelligence, merchants can enhance their fraud detection capabilities and proactively identify and address new threats. Additionally, fostering collaboration within the industry and sharing insights can help businesses stay ahead of fraudsters and protect against evolving risks.

What role do customer education and communication play in fraud prevention?

Educating customers about return policies, purchase verification procedures, and fraud prevention measures can empower them to make informed decisions and detect potential fraud attempts. Clear and transparent communication fosters trust and reduces the likelihood of misunderstandings or disputes, ultimately strengthening the overall security ecosystem.

How can businesses balance fraud prevention with customer experience?

While prioritizing fraud prevention is crucial, businesses must also strive to maintain a positive customer experience. By striking the right balance between security measures and user convenience, merchants can build trust, loyalty, and satisfaction among their customer base. Implementing frictionless return processes, providing timely assistance, and offering fair and transparent resolutions can enhance both security and customer satisfaction.