Buying a website offers opportunities to tap into new audiences, enter new markets, grow your online presence, or generate passive income. While it’s a simpler process compared to merging or acquiring a business, not all website purchases are created equal. However, navigating the process of buying a website requires careful consideration and strategic planning. Whether you’re a seasoned investor or a novice looking to enter the online marketplace, here’s your comprehensive guide to making smart decisions when buying a website.

Steps To Follow When Buying a Website

1. Define Your Goals

Before diving into the market, clearly define your investment objectives. Are you looking for a passive income stream, reaching out to new audiences, a strategic addition to your portfolio, or a project to grow and flip for profit? Understanding your agenda will help guide your decision-making process of buying a website.

Let me give you an example of why a website was purchased. In 2021, Hubspot acquired media startup The Hustle, expanding its brand reach to fresh audiences within the startup and investing communities.

In general, the most successful investments are those aligned with your skills and expertise in growth and management. For instance, refrain from purchasing a media publication if you lack experience in growing a blog. Similarly, if you’re unfamiliar with eCommerce, avoid heavily investing in an online store, dropshipping, or any website dealing with physical products.

2. Conduct Thorough Research

Just like any other investment, thorough research and analysis is key. Research the niche, target audience, competition, and potential for growth while buying a website. Platforms such as Flippa empower individual sellers to list their websites for sale and handle negotiations and asset transfers independently. These marketplaces often feature budget-friendly websites for sale, making them ideal for micro-acquisitions.

From low-risk starter sites priced in the three-figure range to established websites generating substantial monthly passive income, a wide range of options is available for purchase.

Rather than viewing every available website for purchase, brokerages usually offer curated selections that their internal teams have verified. Empire Flippers and FE International are two examples of brokerages specializing in the sale of various types of online businesses.

3. Evaluate the Website’s Performance

Assess the website’s performance metrics, including traffic, engagement, and conversion rates. Look for steady or growing traffic trends and consistent revenue streams. Beware of any red flags, such as declining traffic or unreliable income sources.

Watch out for significant drops in traffic or suspicious spikes in referring domains, as these could indicate declining performance or dubious practices behind the scenes.

To dig deeper in the process of buying a website, examine a site’s link profile in the Backlinks report to focus on potentially troublesome links.

Paid links typically employ the target keyword as anchor text and originate from low-quality sites with subpar content. Be wary of sites with an abundance of such links. If a substantial portion of the links to the site under consideration fit this pattern, it’s a significant warning sign to look up to before buying a website.

4. Assess the Monetization Strategy

Understand how the website generates revenue, whether through advertising, affiliate marketing, product sales, or subscriptions. Evaluate the diversity and stability of the revenue streams and assess their scalability potential. Here are some prevalent trends you might observe before buying a website:

– Stable markets provide reliable, recurring revenue and often serve as the cornerstone of a website’s performance.

– Seasonal markets facilitate audience growth and intermittent revenue boosts but yield inconsistent income.

– Emerging markets with low competition present an excellent chance to establish oneself as a top contender.

– Declining markets offer the opportunity to innovate outdated practices and capture an existing, knowledgeable audience.

5. Analyze the Content and SEO

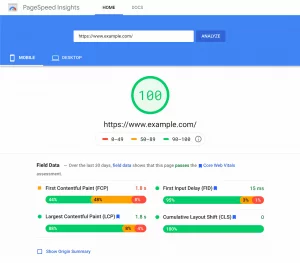

Quality content and strong search engine optimization (SEO) are essential for long-term success. Evaluate the website’s content quality, relevance, and optimization for relevant keywords. Assess the overall SEO health to ensure organic visibility and examine the Site Structure report to understand the website’s information architecture and traffic distribution across its content.

Some are poorly structured websites with decent performance, typically managed by individuals less versed in SEO. These sites have cultivated a genuine audience that appreciates their content. By implementing straightforward SEO best practices, significant improvements can often be achieved within a relatively short period before buying a website.

6. Review Legal and Technical Aspects

Scrutinize legal agreements, licenses, and ownership rights associated with the website, including domain name, content, and intellectual property. Evaluate the website’s technical infrastructure, including hosting, security, and scalability before buying a website.

7. Calculate the Investment Return

Determine the website’s valuation based on its revenue, profitability, growth potential, and market trends. Consider factors such as industry multiples, asset value, and intangible assets. Figure out the potential return on investment (ROI) and assess the risk-reward ratio before buying a website.

Inquire with the seller regarding the historical distribution of profits among their top pages or products. Alternatively, you can evaluate this yourself using the website’s analytics.

Examine the top three pages or products and determine if any are generating over 20% of the traffic or profits. This imbalance might indicate a lack of diversification in the website’s offerings.

While occasionally, it can present opportunities, in other cases, it may pose a significant risk that could potentially be a deal breaker for you.

8. Negotiate and Close the Deal

Once you’ve identified a promising opportunity, negotiate the terms of the purchase agreement, including price, payment structure, and transition support. Consider hiring legal and financial professionals to assist with the negotiation and due diligence process. Bear in mind that negotiations often determine the success of website and business sales.

Before entering negotiations, establish the asset’s value to you and make an offer at approximately 70% of that valuation. Engage in negotiation with the seller to finalize a deal, ensuring not to surpass your predetermined maximum threshold in the heat of the moment. Make sure that a smooth transition of ownership and operations takes place.

Once the deal is secured, the transfer of ownership encompasses all associated assets of the website, including the following:

- Domain name

- Hosting

- Website files

- Email accounts

- Google Business Profile (if applicable)

- Social media accounts (if applicable)

- Financial accounts (if feasible)

In certain instances, migrating the website to a new hosting account is necessary. Proper management of this process is crucial to avoid any adverse impact on the website’s performance. Refer to our comprehensive website migration process to ensure a seamless transition.

9. Plan for Growth and Optimization

Develop a comprehensive strategy for growing and optimizing the acquired website. Identify opportunities for content expansion, audience engagement, and revenue diversification. Implement SEO improvements, marketing initiatives, and conversion optimization techniques to maximize returns.

10. Monitor and Adapt

Continuously assess the performance of the website and adapt your strategies based on market trends, audience feedback, and competitive analysis. Stay informed about industry developments and implement emerging technologies to stay ahead of the curve.

To Conclude

Buying a website can be a rewarding investment opportunity for savvy investors. By following this guide and due diligence, you can make smart decisions about buying a website and maximize your chances of success in the dynamic world of online business. Remember to stay patient, stay focused, and stay adaptive as you navigate the journey of website acquisition and management.

FAQs

Could a website’s performance decline post-sale?

Yes, factors such as poor migration, inflated seller reports, and the removal of fake links can affect performance. Mitigate this by conducting thorough due diligence and considering professional SEO assistance post-sale.

How can I verify a seller’s legitimacy?

Marketplaces like Flippa require careful scrutiny of traffic and profit validation. Brokerages offer stricter seller and analytics verification processes. Rely on gathered information and intuition to assess transparency and trustworthiness.

How can I ensure the website transfer after payment?

Escrow offers a secure payment method for website transactions. Deposit funds into escrow, ensuring successful transfer of website files and access. Once confirmed, the escrow releases payment to the seller, minimizing risk in the transaction.