Being an owner of an online store, you understand the value of having a reliable user interface and functions on your website or app, but what happens if the payment experience is terrible? Customers will eventually lose faith in us, which will result in a decline in sales and customer engagement. The client purchasing process is significantly impacted by the payment gateway.

A good payment gateway should be easy to use, quick, safe, and reliable. The finest payment gateway guarantees the customer’s protection and privacy, enhancing the credibility of the e-commerce website or app. A useful payment gateway should enable businesses to securely accept a variety of payment methods (debit cards, credit cards, wallets, etc.) both online and through mobile apps.

What is a Payment Gateway?

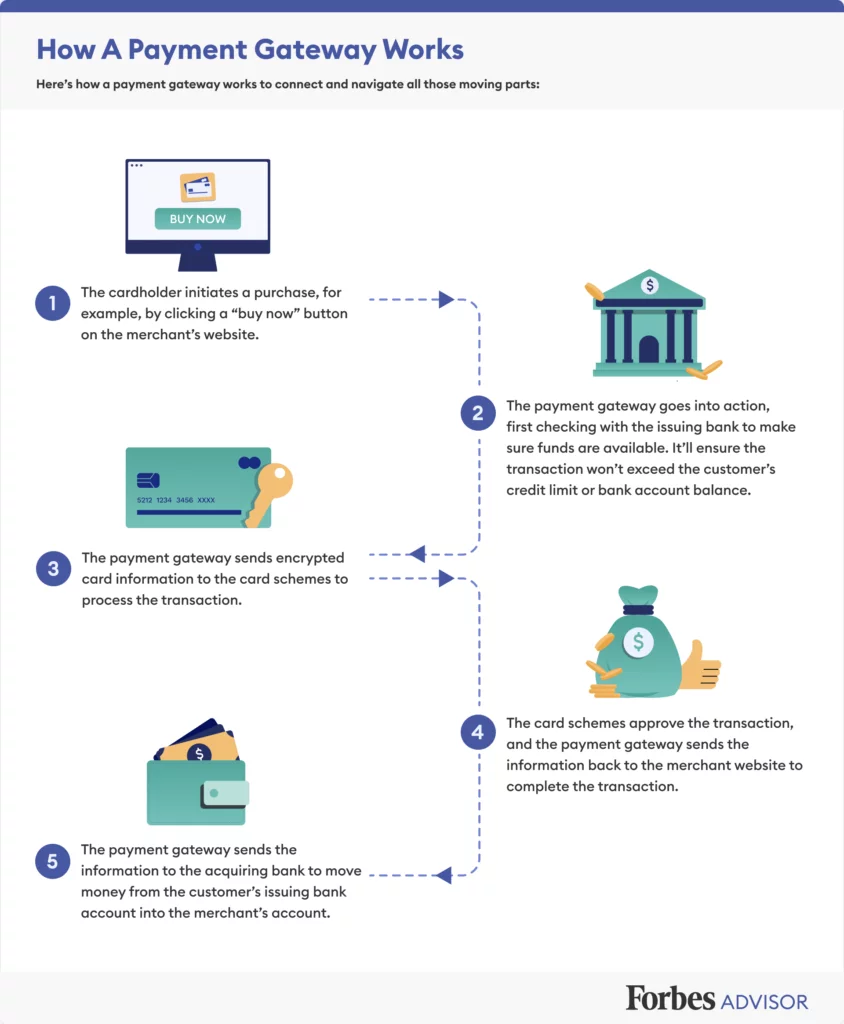

A payment gateway serves as a software application utilized by merchants to facilitate the acceptance of various electronic payments, predominantly credit cards. It operates as an encryption system that safeguards sensitive data, like credit card numbers, during its transmission from the customer to the merchant. These gateways then relay the transaction details to the customer’s bank and the merchant’s acquiring bank (or the bank allied with the merchant for credit card processing).

The primary role of a payment gateway involves authorizing credit card transactions and ensuring the secure transfer of funds from the customer’s account to the merchant’s account. Typically, payment gateways impose a monthly fee alongside a per-transaction charge.

Types of Payment Gateways:

- Redirect Payment Gateways: Redirect payment gateways direct customers away from the merchant’s website during the payment process. Customers are redirected to the payment processor’s website or portal to complete the transaction.

- Operation: Once the customer reaches the checkout stage and selects their preferred payment method, they are redirected to a third-party service, such as PayPal or Stripe, to enter their payment details. After completion, customers are redirected back to the merchant’s website.

- Usage: This method ensures that the merchant doesn’t handle the payment data directly, thereby emphasizing security. However, the user experience might be affected due to the redirecting process.

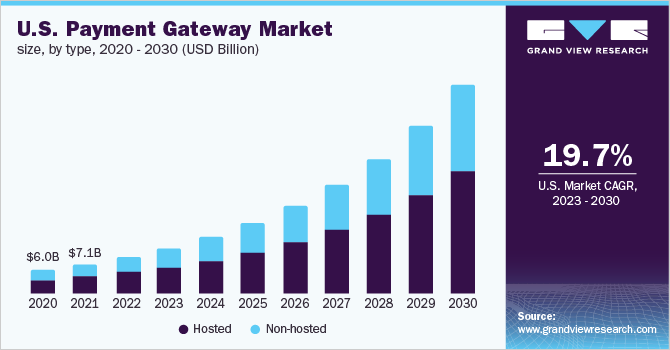

- Hosted (Off-Site) Payment Gateways: Hosted payment gateways allow customers to make purchases directly on the merchant’s website or in a retail setting. However, the payment information is transmitted to and processed on the payment provider’s servers.

- Operation: Customers input their payment details on the merchant’s platform, but the sensitive data is transmitted securely to the payment provider’s servers for processing. Services like Stripe and Square POS systems typically operate in this manner.

- Usage: This method maintains a certain level of security by handling payment data off-site. It reduces the merchant’s responsibility for security compliance but may require more effort in ensuring seamless integration and user experience.

- Self-Hosted (On-Site) Payment Gateways: With self-hosted payment gateways, the entire transaction, from data input to processing, occurs on the merchant’s servers or website.

- Operation: Customers input their payment information directly into the merchant’s website or platform, and the data processing takes place on the same server without redirecting elsewhere.

- Usage: This method grants the merchant complete control and responsibility for the security of the payment process. While it offers more customization and control, it also necessitates a higher level of security compliance and infrastructure maintenance.

Top 10 Global Payment Gateways of 2023

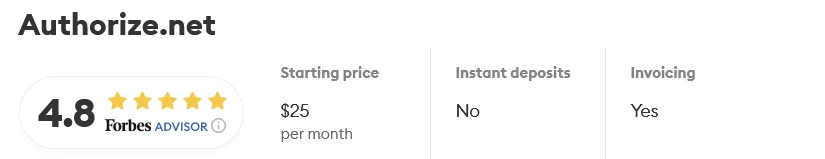

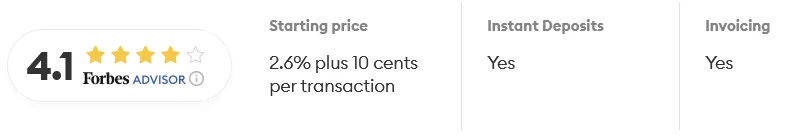

1. Authorize

Authorize.net stands out in fraud prevention, thanks to its Advanced Fraud Detection Suite (AFDS), a robust system developed leveraging years of transaction processing expertise. This suite comprises 13 customizable fraud filters, empowering businesses to set specific parameters like minimum transaction thresholds, payment velocity settings, and geographic restrictions. These tools provide businesses with a proactive approach to authenticate transactions, making it a vital tool for reducing potential losses due to fraudulent activities.

The service’s appeal also lies in its transparent and adaptable pricing models, offering two distinct plans: All-in-One and Gateway-Only, catering to varied business needs. The former includes a merchant account, while the latter suits businesses that already have one. Moreover, both plans come devoid of setup fees and entail reasonable per-transaction costs.

Aside from its anti-fraud capabilities, Authorize.net supports an array of payment types and features, including recurring payments, digital invoicing, and account updater functionality. These features transcend mere payment processing, providing businesses with versatile tools to manage customer transactions effectively.

Ideal for:

Businesses in search of a secure, adaptable payment gateway with robust fraud prevention measures.

Pros:

- Tailored fraud prevention with AFDS

- Offers both all-in-one and payment gateway-only options for flexibility

- No setup fees, minimizing initial costs

Cons:

- Additional charges for specific features like Account Updater and e-check

- Merchant account approval process might take up to five business days, potentially delaying setup.

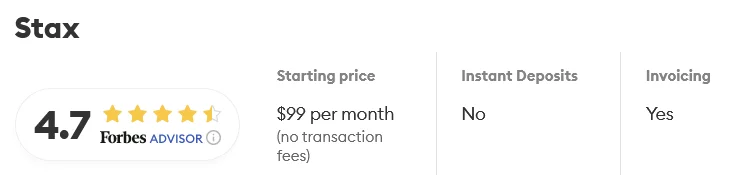

2. Stax

Stax, a payment gateway by Fattmerchant, offers a cost-effective and scalable solution for merchants. Its pricing structure involves a monthly fee along with a per-transaction cost, without any markups on interchange fees. For keyed transactions, the fee stands at $0.15 per transaction, while swipe transactions incur an $0.08 charge. Additionally, Stax integrates invoicing and seamlessly syncs with QuickBooks Online, simplifying accounting processes for users.

One of its standout features is the flexibility it offers in terms of add-ons and optional packages. Businesses have the liberty to pay for only the features they require. For instance, upgraded packages encompass additional functionalities like accounting reconciliation syncing, API key integration, enhanced dashboards, and the provision of a dedicated account manager.

Ideal for:

Stax proves advantageous for businesses with substantial sales volumes (above $5,000 per month) and those aiming for growth. Small-scale merchants benefit from its initial low and predictable pricing, with the ability to upscale features as their business expands.

Pros:

- Flat-rate subscription fee per month, no transaction fees

- Free terminal or mobile reader

- Recurring invoices and scheduled payments

- Digital invoicing and ACH processing

- QuickBooks synchronization

- Customizable with an API

- 24/7 support

Cons:

- Not cost-effective for businesses processing under $5,000 per month

- Additional fees per terminal

- 1% charge for same-day access to funds

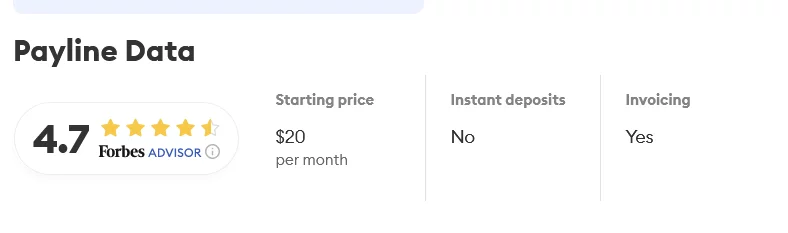

3. Payline

Payline Data stands out as an excellent choice for subscription-based businesses due to its tailored features catering to the specific needs of these models. Its platform adeptly manages core aspects crucial for subscription services, such as recurring billing and invoicing. By automating these essential processes, businesses can significantly reduce administrative workload and streamline their operations.

A notable highlight of Payline Data’s platform is its advanced API and Developer Docs functionality. This feature empowers businesses to create customized integrations with either native or third-party software. This flexibility proves invaluable for subscription-based enterprises, which often require specialized software integrations to optimize their operational workflows.

Moreover, Payline Data includes a Virtual Terminal & Dashboard, offering a centralized hub for managing diverse payment tasks. From processing transactions to accessing reports, storing customer profiles, and sending invoices, these features are indispensable for businesses dealing with regular customer payments.

The platform ensures transaction security by employing modern encryption and tokenization methods to safeguard user and card data. This robust security infrastructure is particularly crucial for subscription-based businesses that routinely handle sensitive customer payment information.

Who Should Opt for Payline Data:

Subscription-based businesses in search of a versatile and secure payment gateway equipped with robust recurring billing and invoicing capabilities.

Pros:

- Advanced recurring billing and invoicing features

- Customizability through API and Developer Docs

- High-grade security measures

Cons:

- Pricing structure might not align with every business

- Requires technical expertise for API utilization

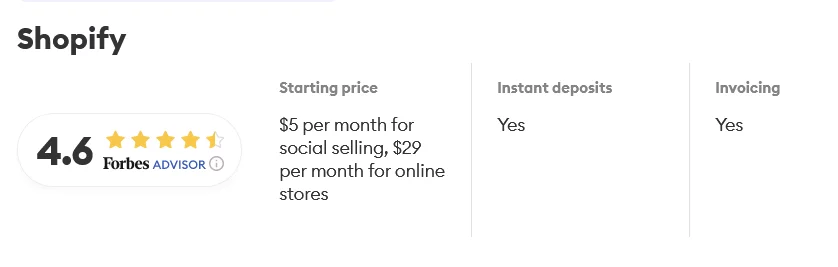

4. Shopify

Shopify stands out as an ideal platform catering to businesses of varying sizes and types, catering equally well to startups and established brands in the ecommerce sphere. Its scalability, paired with a comprehensive suite of ecommerce tools and features, makes it an attractive option particularly for startups. Shopify’s platform fosters creativity and distinctiveness, offering adaptable customization possibilities for online stores.

Centralizing all commerce operations, Shopify simplifies business management, enabling access to the online store from any location. The platform handles server maintenance and software upgrades, streamlining business operations and reducing complexities.

One of Shopify’s key strengths lies in its seamless scalability, offering additional products and services that augment the capabilities of businesses operating on its platform. These solutions offer independent entrepreneurs a competitive edge in the market. For instance, businesses seeking heightened customization can leverage Shopify’s APIs and development tools, enabling them to tailor their online store’s capabilities to precise specifications. This level of customization fosters an enhanced customer experience and expanded functionality. The App Store further enriches these possibilities by offering a wide array of third-party apps that elevate the ecommerce experience.

Who Should Consider Shopify:

Entrepreneurs at any stage of business development aiming to launch, manage, and expand an ecommerce venture. Shopify’s versatile features make it an excellent choice for those entering the ecommerce arena, striking a balance between convenience and customization potential.

Pros:

- Comprehensive and adaptable ecommerce tools

- Scalability in tandem with business growth

- Centralization of commerce activities

Cons:

- Potential cost increments due to add-ons

- Limitations in customization for certain themes

- Might be expensive for occasional or intermittent sellers

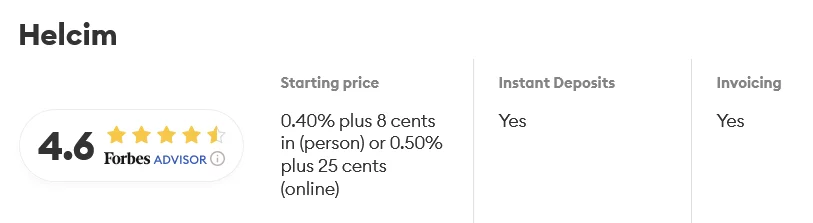

5. Helcim

Helcim is renowned for its cost-effective payment gateway, offering an extensive array of features that include invoicing capabilities, subscription setups, and facilitation of international payments. Its versatile range of APIs empowers users to tailor their payment gateway according to specific needs and preferences.

For businesses handling substantial transaction volumes, Helcim extends volume discounts, automatically applied as transaction volumes increase. This feature eliminates the need for contacting their sales team, ensuring that discounts scale seamlessly with transaction volumes.

Who Should Consider Helcim:

Helcim is most suitable for businesses that handle high transaction volumes. It caters to this clientele by providing volume discounts to mitigate payment processing costs, along with a diverse feature set that can be personalized to optimize operations.

Pros:

- No monthly fee—transaction fees only

- Below-average processing rates

- No binding contracts

- Customizable API for enhanced flexibility

- Automated volume discounts

Cons:

- Flat fee of $10 per month for instant deposits

- Additional cost for hardware requirements

6. Elavon

Elavon stands out as more than just another payment gateway—it’s a comprehensive solution tailored for businesses seeking to integrate their current Point of Sale (POS) systems into a versatile payment infrastructure. It caters to diverse transaction settings, whether it’s a brick-and-mortar store, an online storefront, or a mobile application, allowing businesses to engage customers across different platforms seamlessly.

Its adaptability shines through its ability to process multiple payment methods, spanning traditional card swipes to modern contactless and mobile-wallet transactions. This flexibility enables businesses to address the needs of a wider customer base, irrespective of their preferred payment modes.

Whether a business is a veteran in e-commerce or stepping into the field for the first time, Elavon offers the necessary tools for a smooth transition or expansion. Its robust security measures ensure compliance with Payment Card Industry Data Security Standard (PCI DSS), safeguarding both business and customer payment data.

The platform’s reporting and reconciliation features empower businesses to efficiently manage their payment accounts, minimizing administrative burdens and allowing greater focus on core business operations.

Who Should Consider Elavon:

Elavon suits businesses aiming for a seamless integration across various payment environments, particularly those seeking an efficient solution to merge with existing POS systems.

Pros:

- Accommodates physical and digital transaction environments

- Supports a wide range of payment types, catering to diverse customer preferences

- Implements advanced security measures ensuring PCI DSS compliance

Cons:

- Lack of transparent pricing information

- Platform navigation might pose challenges for businesses new to digital payments

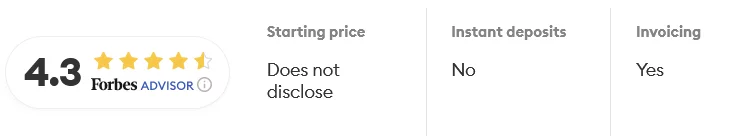

7. Square

Square’s forte lies in its Point of Sale (POS) system, renowned for facilitating in-person payments for retailers. But beyond this, Square offers an extensive payment gateway equipped with functionalities such as invoicing, subscription setup, and international payment processing. Its wide array of APIs enables customization of the payment gateway to align precisely with diverse business needs.

What distinguishes Square from its competitors are its supplementary features. Users can leverage customer relationship tools to foster loyalty among patrons and utilize employee management tools for effective hour tracking. Additionally, Square provides inventory management solutions and advanced reporting tools to enhance overall business management.

Who Should Consider Square:

Square is an ideal choice for businesses seeking tools to cultivate customer loyalty and encourage repeat business.

Pros:

- No monthly fee

- Transparent per-transaction pricing

- Cost-effective hardware solutions

- Flexible buy now, pay later options for both in-person and online transactions

- Diverse integrations and add-ons available

Cons:

- Additional costs for the customer loyalty program

- Lack of phone support

- Limited customer support hours

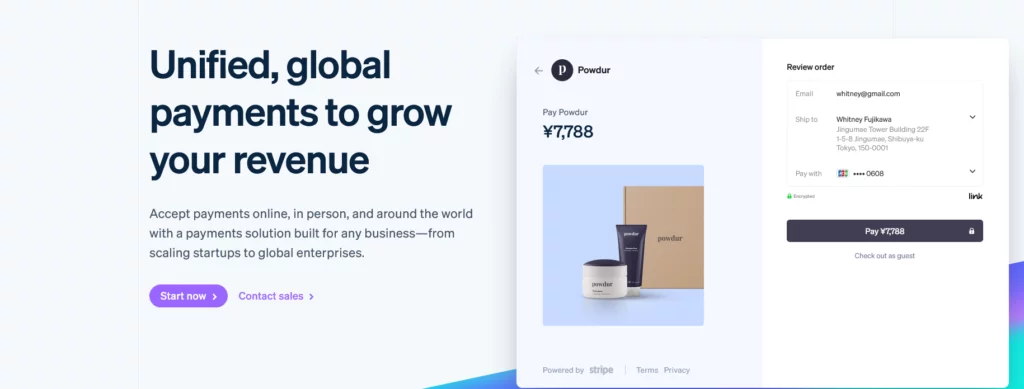

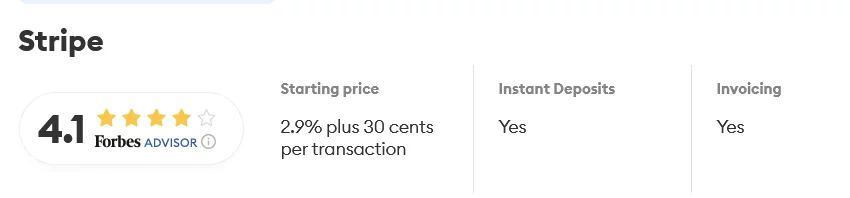

8. Stripe

Stripe is recognized primarily for its payment processing solutions, although it also boasts a comprehensive payment gateway. The Stripe Terminal seamlessly integrates with your in-person payment system, enabling you to accept payments from various sources. It’s especially advantageous for businesses aiming to create a tailored payment solution or those requiring in-person payment acceptance.

Beyond its Terminal, Stripe offers an extensive array of features, facilitating invoice creation, subscription setups, and international payment processing. Its vast collection of APIs empowers businesses to tailor their payment gateway precisely to their needs.

Who Should Consider Stripe:

Stripe is well-suited for businesses seeking extensive customization options or requiring in-person payment acceptance. Its APIs allow customization of both the payment gateway and point-of-sale (POS) solutions, making it versatile for terminal-based transactions.

Pros:

- No monthly fee

- No setup fees

- Developer-friendly interface

- Highly versatile due to extensive customizations and integrations

Cons:

- Instant deposits cost 1% of the transaction

- Lack of native inventory management features

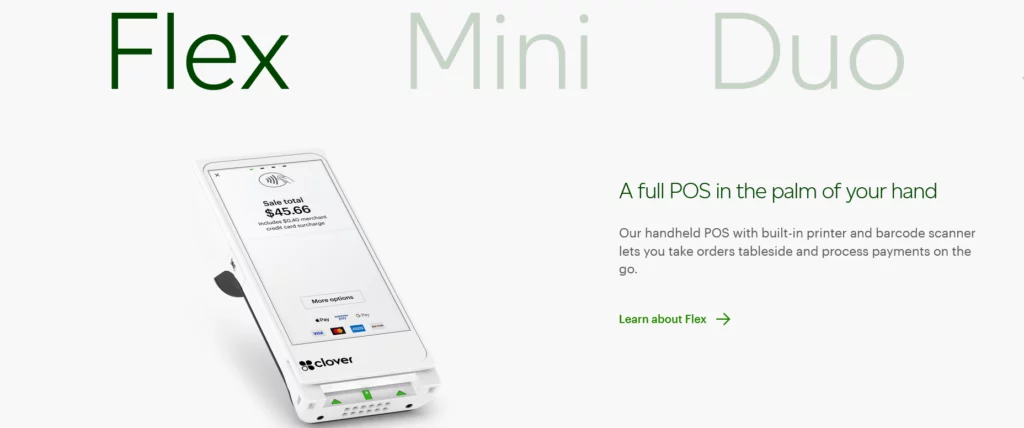

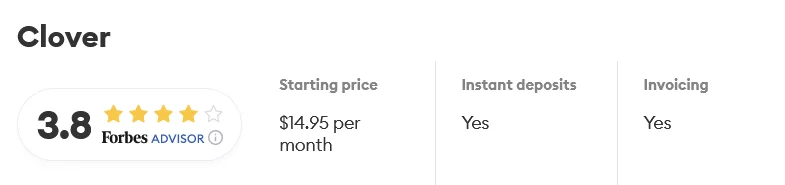

9. Clover

Clover stands out as a dependable ally for restaurants, reshaping their daily functions with its intuitive design and robust features. Its tailored POS systems transcend mere payment gateways, serving as multifunctional tools designed to adapt to the dynamic pace of restaurant operations.

Imagine a bustling Friday evening. The front-of-house staff juggles numerous orders and split checks, while the kitchen strives to maintain order amid culinary chaos. Here, Clover seamlessly integrates with the front-of-house dynamics. Its order management system effortlessly tracks orders and handles split checks, alleviating staff from complex bill divisions and ensuring faster table turnovers.

In the back-of-house realm, Clover’s tracking capabilities bring structure to the controlled chaos. Real-time inventory updates assist chefs in maintaining a consistent workflow, averting unexpected surprises during peak hours. Additionally, its reporting system streamlines operations by providing actionable insights, spanning from sales trends to staff performance.

Even during downtime, Clover remains active. Its payroll integrations simplify the otherwise daunting task of managing wages, taxes, and tips. This reduces the administrative burden, allowing restaurateurs to focus on creating memorable dining experiences.

Offering a wide spectrum of payment options, from traditional credit cards to mobile wallets, Clover respects the diversity of customer preferences, ensuring seamless transactions. More than just a payment gateway, it’s a comprehensive solution, a boon to the restaurant industry, seamlessly integrating with every facet of restaurant operations—front-of-house, back-of-house, and beyond. The outcome? A smoother dining experience for customers and a more efficient, manageable operation for restaurant owners.

Who Should Consider Clover:

Restaurants seeking a comprehensive, adaptable, and transparently priced solution for streamlined operations and diverse payment acceptance.

Pros:

- Well-structured and transparent pricing plans

- Comprehensive feature set, including order management, tracking, and loyalty programs

- Accepts a wide variety of payment methods

Cons:

- May have a learning curve for users with limited technical expertise

- Optional add-ons can increase costs

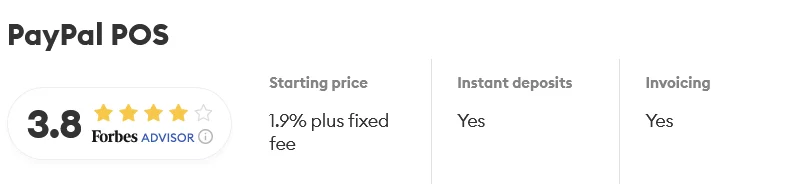

10. Paypal

PayPal sets itself apart with its unparalleled versatility and worldwide acclaim. As a payment solution catering to diverse business needs, PayPal ensures secure transactions for both online and in-person sales. Its seamless integration across major ecommerce platforms simplifies the process of linking an online store to a PayPal Business account. This user-friendly approach extends to financial services, offering options for business loans, credit cards, and debit cards. The platform streamlines daily operations by providing insights into shopper behavior, risk management, and operational efficiency.

One of PayPal’s most compelling strengths is its ability to drive checkout conversion rates. Businesses leveraging PayPal often witness an uptick in repeat customers and a notable increase in transaction frequency. This is primarily due to the global trust customers place in PayPal for their transactions. An impressive 69% of PayPal customers express feeling more secure shopping at merchants that accept PayPal.

Even post-transaction, PayPal stands as a reliable partner with efficient customer support available via call or live chat. Regarding pricing, there are no hidden costs—fees are applied only when businesses make a sale, offering an economically viable solution. However, for high-volume sellers, exploring alternative platforms on our list may yield better rates.

Who Should Consider PayPal:

Businesses seeking versatile and globally recognized payment solutions that enhance customer trust and conversion rates.

Pros:

- Versatile payment solutions catering to various business needs

- Strong global recognition bolstering customer trust

- Efficient customer support, even after sales

- Transparent pricing with no monthly fees

Cons:

- May not be economically feasible for high-volume sellers

- Known for fund holds from sellers and occasional account closures with limited recourse

What to Consider Before Finalizing a Payment Gateway:

1. Security and Compliance: The foremost concern is security. Ensure the payment gateway complies with Payment Card Industry Data Security Standard (PCI DSS) and offers robust encryption to protect sensitive customer data from potential cyber threats and fraud.

2. User Experience: A seamless and user-friendly payment process is vital. Complicated or lengthy checkout procedures can lead to cart abandonment. Look for gateways that offer a frictionless experience across devices and payment methods.

3. Integration and Compatibility: Check if the payment gateway integrates smoothly with your e-commerce platform or website. Compatibility issues can disrupt transactions and create inconvenience for both you and your customers. Assess the ease of integration and the technical support available.

4. Range of Payment Options: Customers prefer diverse payment options. Ensure the gateway supports various payment methods like credit/debit cards, digital wallets, bank transfers, and alternative payment methods to cater to diverse customer preferences.

5. Fees and Costs: Understand the fee structure of the payment gateway. Assess transaction fees, setup costs, monthly subscription fees, and any hidden charges. Ensure these align with your budget and expected transaction volumes.

6. Customer Support: Reliable customer support is crucial. Issues might arise, and prompt, efficient assistance can prevent disruptions in your business operations. Check the availability, responsiveness, and quality of customer support offered.

7. Reputation and Reliability: Research the reputation and reliability of the payment gateway provider. Look for user reviews, testimonials, and industry ratings to gauge the reliability and credibility of the service.

8. Global Reach and Multi-Currency Support: If your business operates globally, ensure the payment gateway supports transactions in multiple currencies. This capability allows for seamless transactions across different regions, accommodating international customers without hassle.

9. Payout Period and Terms: Evaluate the payout frequency and terms offered by the payment gateway. Understand the payout timelines and any thresholds required for transferring funds to your business account.

10. Scalability: Consider your business growth. Choose a payment gateway that can scale with your business, accommodating increased transaction volumes and offering additional features as your business expands.

Conclusion:

In conclusion, payment gateway providers play a pivotal role in the modern digital economy, serving as the linchpin for secure and efficient online transactions. Their multifaceted functions, ranging from ensuring transaction security to enabling diverse payment methods and seamless integration, are integral to the success of businesses operating in the online space.

The evolution of these providers has not only simplified payment processes but has also elevated customer confidence in conducting online transactions. Their adherence to stringent security measures, compliance standards, and commitment to providing reliable support underscores their significance in facilitating the smooth flow of commerce across various industries.

FAQs About Payment Gateways:

How do I add a payment gateway to my website?

- Start by selecting a payment gateway provider and signing up for a merchant account.

- Obtain the API key, then integrate the code into your website. Some gateways offer simple drop-in solutions, while others require more complex development work.

Do I need a payment gateway?

While not mandatory, payment gateways are crucial as cash transactions decrease. Without credit card processing options, businesses risk missing out on sales.

Can I build my own payment gateway?

Yes, creating a custom, self-hosted payment gateway on your servers is possible. This grants complete control over the transaction experience but also puts security responsibilities on you.

What is a multicurrency payment gateway?

A multicurrency payment gateway enables accepting payments in various currencies and receiving settlements in your local currency. This is vital for global transactions and catering to diverse customer bases.